Face-swapping fraud sparks AI-powered crime fears in China

China is dealing with a major deepfake scam, which has raised concerns about an increase in fraudulent activities utilising AI tools such as face swapping and voice mimicry.

The case revolves around a prominent tech firm in Fuzhou, whose legal representative was reportedly swindled out of RMB 4.3 million ($610,000) after engaging in a video call with an imposter posing as a “friend” through the exploitation of AI face-swapping technology.

This incident has triggered extensive discussions on the ability of AI to deceive well-educated individuals in a matter of minutes. While China is still in the early stages of formulating regulations for AI, the nation’s internet regulator recently released a draft regulation addressing the use of generative AI and invited public input on the proposed measures.

The initial enthusiasm surrounding advancements like ChatGPT in China has been overshadowed by apprehensions regarding the potential misuse of AI to facilitate criminal endeavors.

https://technode.com/2023/05/24/face-swapping-fraud-sparks-ai-powered-crime-fears-in-china/

Tencent’s super app WeChat announced the official introduction of palm payment

WeChat’s palm pay feature demonstrates its adaptability to varying lighting conditions and the unique physiological characteristics of individuals’ palm lines.

This innovative payment method has been initially introduced on the subway line that connects to Beijing’s Daxing Airport. By utilizing this newly launched feature, users can now complete their entire boarding process without the need for their smartphones.

https://mp.weixin.qq.com/s/z664BYdriVy1_tbwSSHbWA

China Social Media In 2023: The Brand Guide To WeChat, Douyin, Xiaohongshu And Other Platforms

In China, the luxury goods market is flourishing, offering a significant opportunity for brands to captivate the interest of Chinese consumers. It is crucial for luxury brands to carefully select the appropriate social media platforms to establish connections with younger demographics.

By actively participating in relevant discussions and fostering a community centered around broader themes, brands can easily connect with users on platforms such as Xiaohongshu. To resonate with Chinese consumers, luxury brands should strive for subtle, sincere, and locally tailored storytelling.

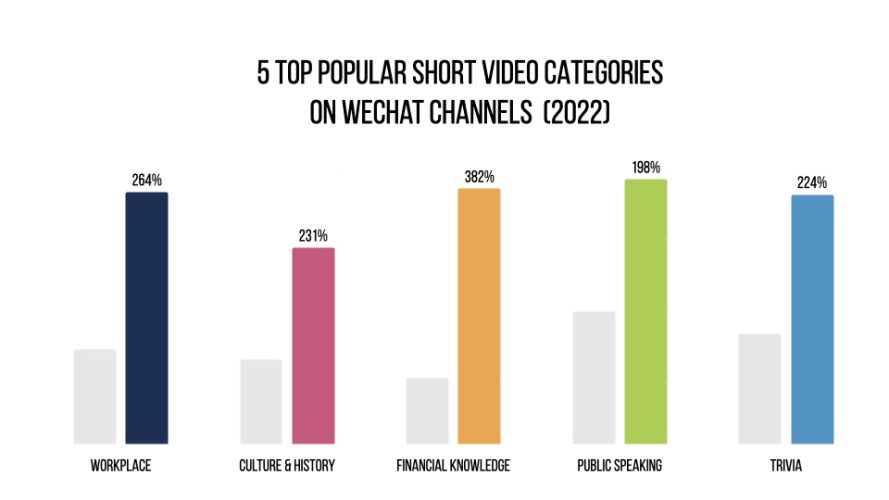

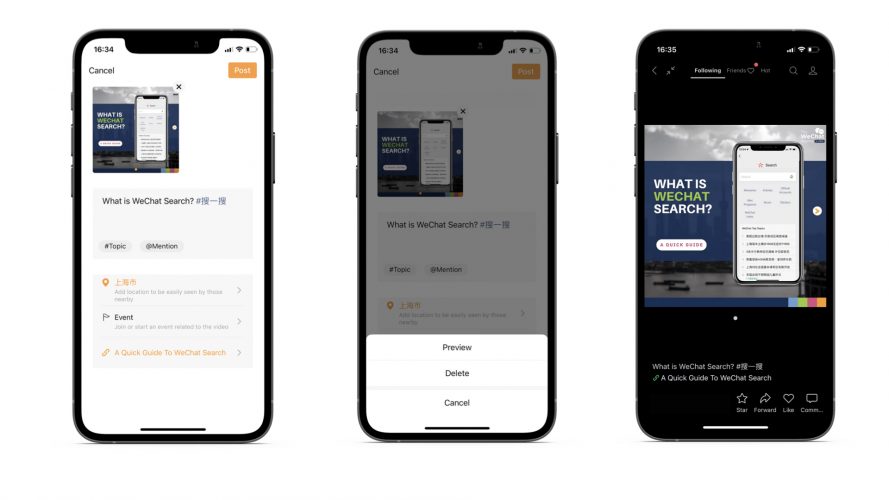

Incorporating gamification elements on platforms like WeChat can enhance a brand’s social standing and create exciting opportunities beyond traditional features. Furthermore, leveraging short videos with compelling narratives on platforms like Weibo can establish profound emotional bonds with audiences and effectively convey brand messages.

https://jingdaily.com/chinese-social-media-xiaohongshu-douyin-wechat-weibo/

Strong Domestic Travel Rebound In China Foreshadows Return Of Global Chinese Tourism

Chinese Gen Z individuals are embracing the trend of “Dopamine Dressing Style,” which aims to embody joyfulness through clothing choices.

This new fashion phenomenon, characterized by vibrant and vivid colors, is believed to have originated among university students.

One of her short videos, featuring five colorful outfits representing different moods throughout the weekdays, has gained significant exposure and attention.

The popularity of the “Dopamine Dressing” style reflects the increasing significance of emotions in the fashion industry’s consumer journey, particularly among the post-90s and post-00s generations.

By utilizing colors as a medium for emotional expression, individuals can experience an enhanced sense of pleasure, effectively triggering the chemical messenger of happiness.

How has China’s Gen Z turned the happy chemical Dopamine into a fashion fad?

The Chinese Traveler Is A Global Luxury Consumer

The post-pandemic luxury industry will continue to witness a significant presence of Chinese travelers, and luxury companies should be prepared for their return.

In light of the three-year-long COVID-19 restrictions, brands must adapt and comprehend the changes in Chinese consumer behavior and expectations.

To strengthen customer relationships and ensure consistent experiences, it is crucial for luxury companies to utilize Chinese digital platforms such as WeChat, RED, and Dianping.

Emphasizing digital capabilities that facilitate product searches, store appointment bookings, and seamless integration with popular payment platforms like WeChat Pay and Alipay is of utmost importance.

Collaboration between global brand teams and local Chinese teams is necessary to cater to the needs and expectations of Chinese travelers, viewing them as a global consumer profile and delivering coherent experiences across the digital landscape.

https://www.luxurysociety.com/en/articles/2023/05/chinese-traveller-global-luxury-consumer?ueid=3a844b2001