Kuaishou, often referred to as “Kwai” in English, has become a significant player in China’s short video landscape, rivaling other giants like Douyin (known as TikTok internationally). With its roots tracing back to 2011 as a GIF creation app, Kuaishou evolved into a full-fledged short video platform by 2013. Over the years, it has grown exponentially, becoming a go-to app for millions of users across China, especially in lower-tier cities and rural areas.

Differentiation from Competitors

Kuaishou stands out from its competitors, particularly Douyin, in several key ways. While Douyin has gained popularity primarily among users in China’s more developed, urban areas, Kuaishou has carved out a niche in lower-tier cities and rural regions. This focus has allowed Kuaishou to cultivate a unique community atmosphere that is more intimate and less commercialized than Douyin.

One of the most significant differences is the content recommendation algorithm. Kuaishou’s algorithm prioritizes user relationships and interactions over purely viral content. This means that Kuaishou users are more likely to see content from people they follow or have interacted with, leading to a more community-driven experience. In contrast, Douyin’s algorithm tends to push trending content, creating a more entertainment-focused environment. This revamped “Laotie” vibe on the platform. Originally used in Northern China to describe a bond as close as brotherhood, “Laotie” is now widely adopted by Kuaishou users, symbolizing the deep trust and strong connection between creators and their fans.

Kuaishou Laotie Gala poster

Another distinguishing factor is Kuaishou’s emphasis on inclusivity and authenticity. The platform encourages users to share their daily lives, often in raw, unfiltered formats. This approach has resonated particularly well with users outside of China’s major urban centers, where people are drawn to content that reflects their own experiences and lifestyles.

Core Features and Functions

Kuaishou offers a rich set of features that cater to a wide range of user needs. Among the most popular features is live streaming, which has become a cornerstone of the platform. Kuaishou’s live streaming feature allows users to broadcast their lives in real-time, attracting audiences that can engage through comments, virtual gifts, and other interactive tools. The platform’s live streaming function is particularly popular among influencers and content creators who use it to build and maintain a loyal fan base.

E-commerce integration is another significant aspect of Kuaishou’s appeal. The platform has seamlessly merged content creation with online shopping, allowing users to purchase products directly from the app. This has given rise to a new form of social commerce, where influencers and everyday users alike can sell products during live streams or through their video content. Kuaishou’s e-commerce ecosystem has been particularly successful in driving sales for small businesses and local brands, further strengthening its ties to rural and lower-tier markets. Total e-commerce GMV in first quarter 2024 was RMB288.1 billion, representing an increase of 28.2% from RMB224.8 billion for the same period of 2023.

Screenshots from Kuaishou Live Streaming

Community engagement is at the heart of Kuaishou’s user experience and helps content creators in Kuaishou win high-stickiness fans. The platform fosters a sense of belonging through its user-generated content model, where anyone can become a creator and share their stories. Unlike other platforms that may prioritize professional or highly polished content, Kuaishou celebrates authenticity. This has created a diverse content landscape where users can find videos ranging from everyday life moments to niche hobbies and interests.

Key Statistics and Market Presence

Kuaishou boasts impressive statistics that underline its dominance in the market. As of the first quarter of 2024, the platform had over 600 million monthly active users (MAUs), with daily active users (DAUs) exceeding 300 million. These numbers reflect a broad and engaged user base, with users spending an average of 85 minutes per day on the app. Kuaishou’s user base is not only vast but also highly active, with a significant portion contributing content regularly.

Kuaishou’s market presence extends beyond China, with a growing user base in Southeast Asia, Latin America, and other regions. The company’s successful IPO in February 2021 on the Hong Kong Stock Exchange further solidified its status as a global player, raising over $5 billion and giving it a market capitalization that briefly surpassed $160 billion.

User Demographics and Popularity

Kuaishou’s user base is diverse, but it is particularly popular among users in China’s lower-tier cities and rural areas. This demographic skews younger, with a significant portion of users aged 18 to 35. The platform’s appeal in these regions can be attributed to its focus on relatable content and community-building features that resonate with users outside of China’s metropolitan hubs.

In contrast to platforms that cater primarily to urban, affluent users, Kuaishou has succeeded in creating a space where people from all walks of life can connect and share their experiences. This has made it a cultural force in China, reflecting the voices and stories of those often underrepresented in mainstream media.

Future Potential

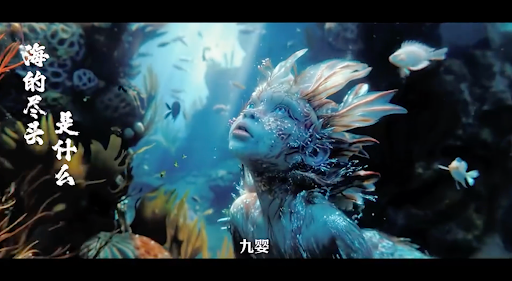

Kuaishou has taken major steps into the AI industry with the introduction of the Kling Large Model, a cutting-edge AI system that generates high-quality videos from text prompts. This technology is aimed at boosting Kuaishou’s ultrashort drama sector, where demand far outweighs supply. With 94 million users watching more than 10 episodes daily, Kuaishou is addressing the content shortage by increasing the number of creators and enhancing their productivity by AI technology. A standout example is Chen Xiao’s short drama The Mirror of Mountains and Seas: Breaking Waves, which utilized the Kling model alongside other tools. The drama received over 52 million views, becoming the platform’s top ultrashort drama.

The Mirror of Mountains and Seas Kuaishou

Conclusion

Kuaishou has firmly established itself as a major player in the global short video landscape, offering a unique platform that blends content creation, live streaming, and e-commerce. Its focus on community, authenticity, and inclusivity has allowed it to thrive in markets where other platforms may struggle to gain traction. As Kuaishou continues to expand its reach both in China and internationally, it remains a platform that empowers users to share their stories, build connections, and engage with content that truly reflects their lives.