You might know Valentine’s Day, but what if we told you that there’s another love day in China, where people celebrate love by sharing gifts with their loved ones? Yes, it’s ”520 Day”. China has more romantic holidays than most nations, with Valentine’s Day falling on February 14, 520 Day falling on May 20, and the Qixi Festival falling on August 22 this year.

You should be aware of 520 Day if you sell gifts such as jewelry, watches, handbags, or even automobiles. Valentine’s Day might not be a big deal in China. Instead, that happens most often on May 20 also called 520. Because it’s a consumer-focused holiday with a significant online component and gift-giving as a core element, it’s crucial for retailers to be aware of it.

Let’s get to know more about 520 days and how marketers can take advantage of them.

What is 520 in China?

Chinese users began using the term “520” online to shorten the phrase “I love you,” much like English speakers do with “ILY” or “ILU,” which is how 520 Day got its start. This is because when spoken in Mandarin, the phrase “I love you” (wǒ ài nǐ) sounds very similar to 520 (wǔ èr líng).

In China, it is not a recognized public holiday. However, on this special Day, restaurants and movie theaters are much more crowded and expensive in the evening. Also contrary to Qixi festival which is deeply rooter in Chinese tradition, ‘520’ is a purely commercial holiday coined only in recent years. It doesn’t take any of its allure and fun!

💕 Why should brands include Qixi, the Chinese Valentine’s Day, in their marketing strategies?

Is February 14 not so important anymore?

Valentine’s Day this year appears to be less busy than in years past. Big luxury brands like Louis Vuitton, Dior, Gucci, and Balenciaga didn’t launch any related initiatives in China. Social media platform Xiaohongshu recorded only around 50,000 posts mentioning “Valentine’s Day 2023” as of February 13, slightly fewer than the same period last year.

The general public does celebrate Valentine’s Day even though the holiday’s origins don’t have much cultural resonance with local shoppers. However according to a Chinese survey, people prefer traditional Chinese romantic celebrations like the Qixi Festival and 520 Day to Valentine’s Day.

Valentine’s Day is unlikely to gain popularity in China as consumers turn toward their own cultural heritage and brands prefer to leverage guochao in their marketing communication.

This dynamic explains why high-end businesses have made marketing around more regional events a top priority. For the following significant romantic festival, 520 Day, luxury players will probably go all-out.

How are the other brands doing it?

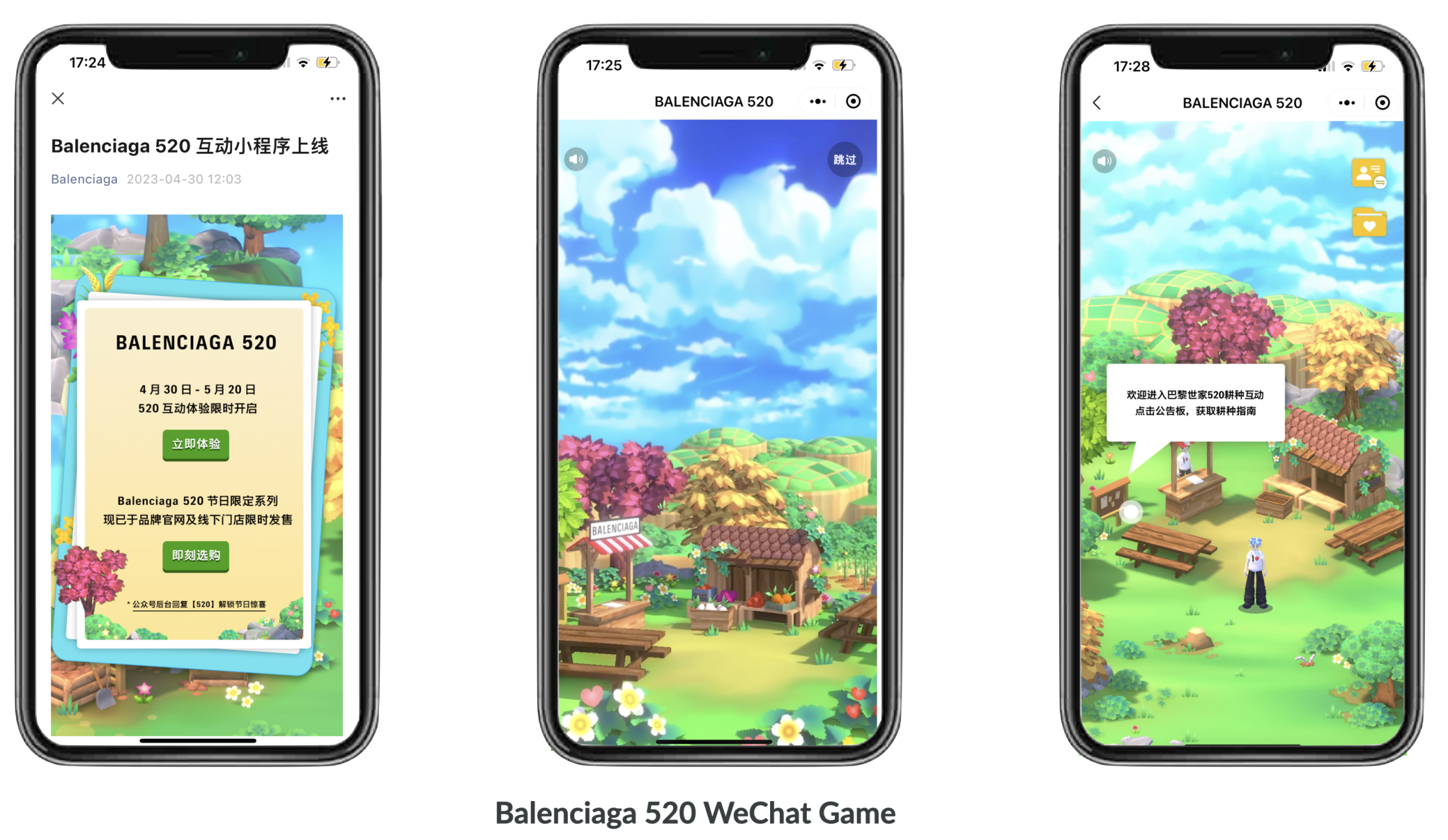

Balenciaga 5:20 video game hall

Last year, Balenciaga launched a campaign that featured a number of charitable endeavors and limited editions, all of which were offered on their official website and in physical stores. One standout was the “5:20 Video Game Hall,” a virtual arcade with pixel art and a lifelike soundscape that is currently available on the company’s WeChat channel until May 20. Alongside this, WeChat memes and 520-only profile pictures were made available for free download.

This year, the brand prepared a range of 520-exclusive products such as T-shirts and other accessories. These can be decorated using included garment marker. There is also a beloved gaming component but this time users become farmers growing virtual crops using regenerative agricultural techniques.

🎮Female Gaming – One of China’s Most Promising Trends

Saint Laurent’s Tmall Super Brand Day

Since the beginning of its campaign on April 30 in conjunction with Tmall Super Brand Day, French luxury fashion house Yves Saint Laurent has amassed hundreds of millions of cumulative exposures online.

The pink version of its Kate bag line was first introduced during the campaign. The color symbolizes love.

Saint Laurent has created an interactive 3D experience that enables customers to try on the various styles in an immersive setting. In addition to enlisting the help of celebrities and KOLs on social media.

Special 520 products from Bvlgari

On May 1, Bvlgari launched a campaign to promote its 520 products, and to do so, it used Weibo’s pop-up advertisements to introduce Wu Lei as its 520 campaign spokesperson.

The first 1000 customers who spend more than 20,000 RMB between April 20 and May 20 will receive special 520 stickers. The first 300 customers who order 520 items online will also receive a special festival-related stamp in the mail.

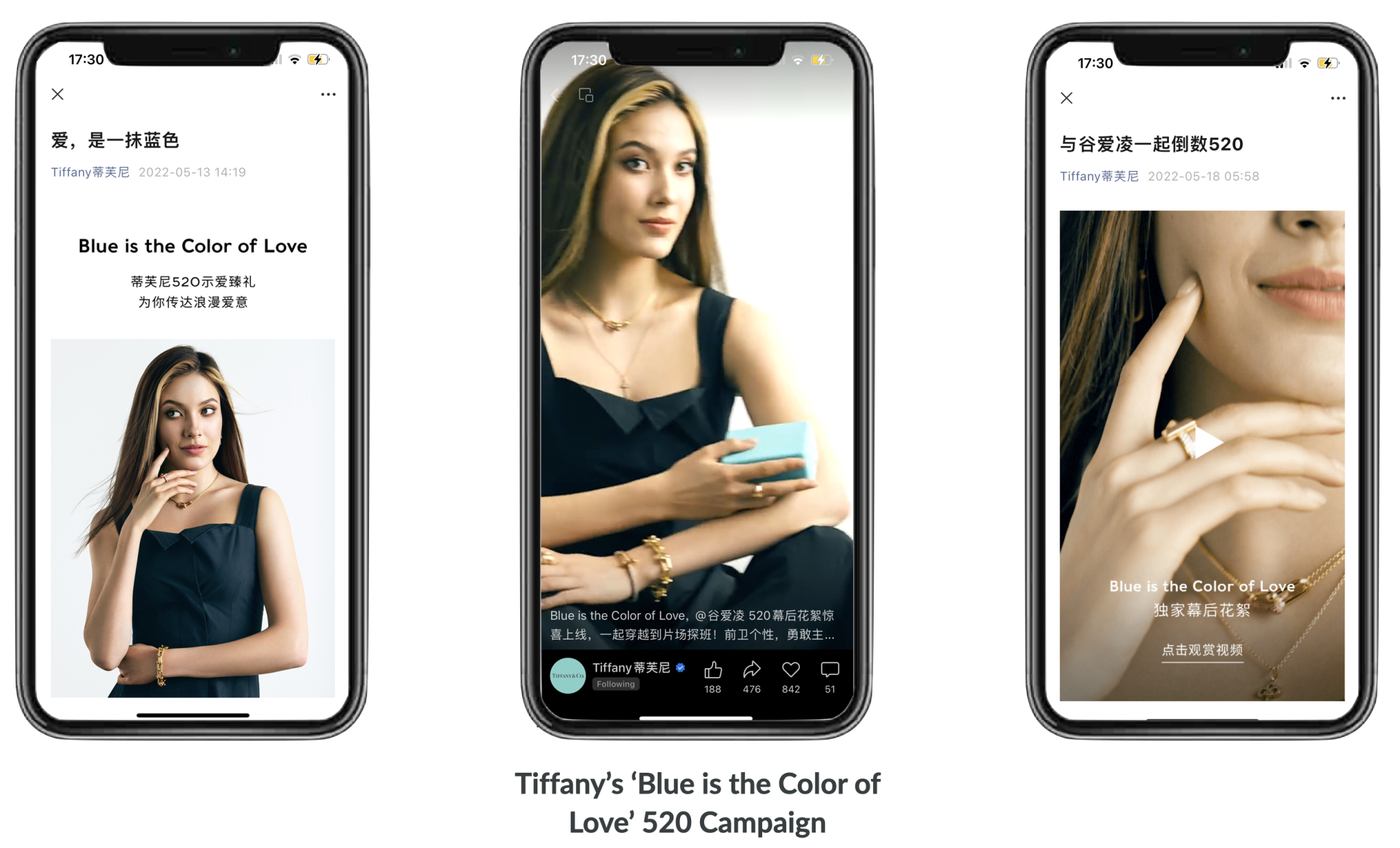

Tiffany’s limited edition ruby necklace – “Blue is the Color of Love”

Tiffany presented a limited edition Tiffany Hardwear necklace set with rubies to commemorate Valentine’s Day this year. Olympic gold medalist and model Eileen Gu was the face of the luxury jeweler’s advertising campaign.

Gu’s support for this cause has increased its social media engagement: as of publication, the campaign hashtags #ElieenGuTiffanytheColorofLove and #ElieenGuColorson on Weibo had amassed a combined viewership of 230 million, a sizable number for a commercial ad.

With comments like “mysterious,” “high-end,” and “gorgeous,” 99 million people have viewed Tiffany’s iconic blue box.

“V” for love from Valentino

The Valentino Garavani 520 Mini Loc handbag campaign featured the letter “v” from the word “love” concealed inside the iconic logo of the accessory.

The theme of the campaign was that love is a special declaration between two people. Along with this storytelling, the celebrity partnerships for the campaign received overwhelmingly positive reviews from online users.

One of the top 3 trending topics on Weibo on May 10 was the hashtag #LayZhangJessicaJung, which received 100 million views in a single day.

Maison Margiela’s “I love” twist locker

Margiela introduced Aa New Lock handbag exclusively in China. The piece made its debut in Maison Margiela’s Avant-Premiere Spring-Summer 2022 collection, embellished with pistachio green leather and an “I love” twist locker.

Multiple sets of character strings with associations to love can be found in the accessory’s twist locker’s special edition. When the bag is locked, the phrase “I love” is visible; when it is unlocked, a number of options are available, including “You,” “The Earth,” “My Cat,” and “Maison Margiela.”

Prada: Mathematics of Love

One of the first high-end companies to launch its 520 campaign in China was Prada. The “Mathematics of Love” campaign examines love in the context of the post-pandemic era. It defines love as both universal and particular, timeless yet also linked to the present.

A special selection of 520 products are available through a WeChat pop-up shop.

Louis Vuitton: Treasure Hunt

Louis Vuitton released a 90-second short film on May 12 to commemorate 520 Day. The film shows a treasure hunt on the company’s monogram handbags led by the actress Song Jia and livestreamer Li Jiaqi.

Li’s on-screen persona is unusual for Louis Vuitton, which has traditionally favored celebrities with sizable fan bases; however, his endorsement seems to have greatly impressed netizens, as his Weibo campaign post garnered over 4.2 million views.

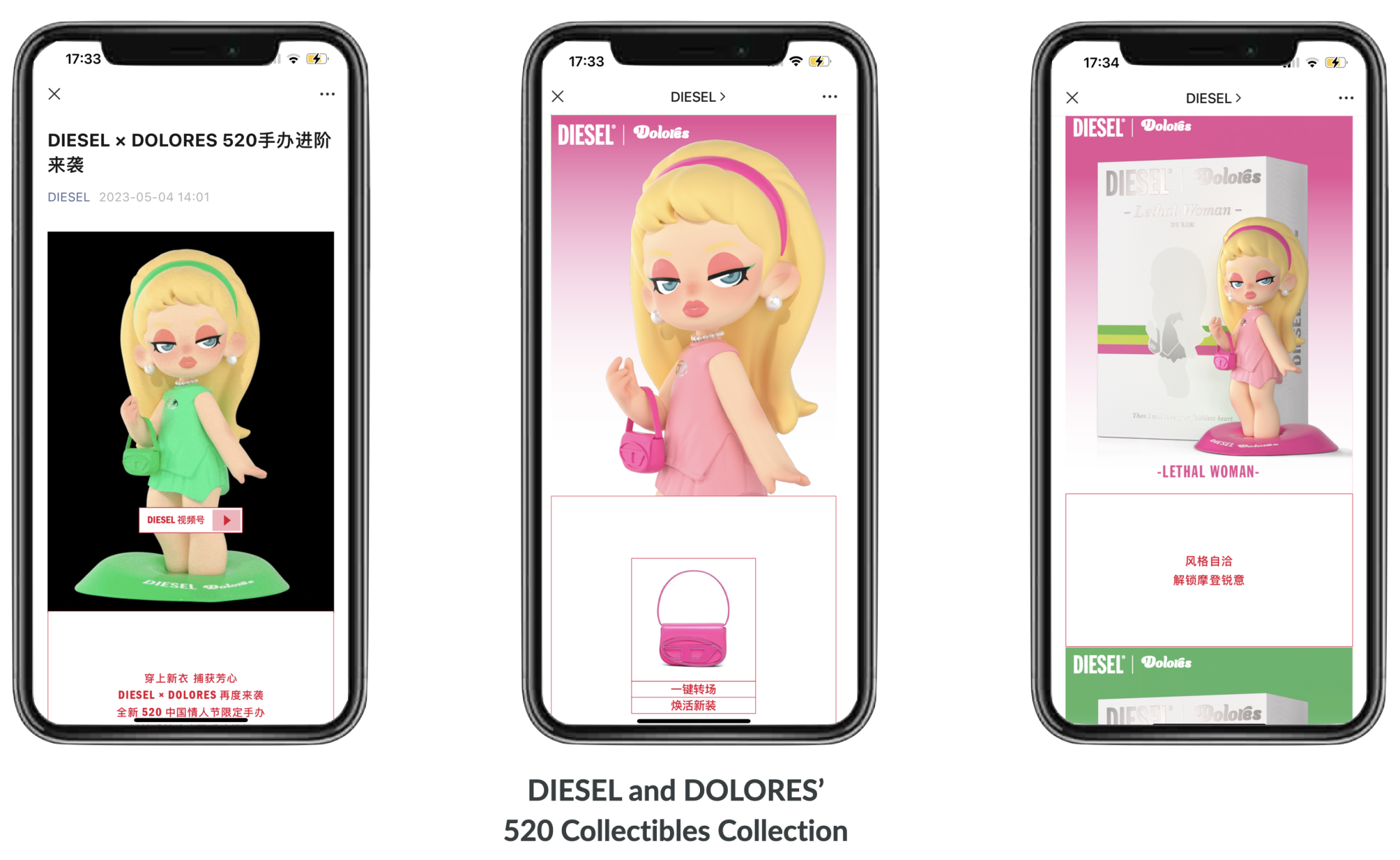

Diesel Taps Collectible

Diesel and Dolores, a company known for its collectible toys, worked together to produce 520 Valentine’s Day figurines this year.

The art toys come in three colorways: neon pink, neon green, and neon yellow. They feature Diesel’s Spring 2023 collection and its best-selling 1DR handbags.

📅 Discover our China’s 2023 Marketing Calendar

Conclusion

Referencing well-known Chinese holidays or launching specific promotions can be a very effective way to engage customers. However, it’s equally crucial to ensure your messaging and imagery are culturally sensitive. Do not rely on stereotypes, or you run the risk of gravely offending your audience.

If you want to know more about the Chinese market and how we can help your business, contact our team. We use our knowledge and expertise to help businesses build meaningful partnerships and develop their networks among Chinese customers. For additional information, please contact us at contact@thewechatagency.com.