The COVID-19 pandemic has accelerated the shift towards online business for businesses around the world. As a result, WeCom, a communication and collaboration platform developed by Tencent, has become increasingly popular among businesses. It offers video conferencing, instant messaging, and file sharing, making it a valuable tool for remote work.

Moreover, it has also helped businesses adapt to new customer behaviours and preferences, such as online shopping and virtual events, and stay connected with their customers in the absence of face-to-face interactions. Online communication tools like WeCom have become essential for companies looking to stay competitive in the current business environment.

Let’s get to know this platform in more detail in this article.

What is WeCom?

WeCom, developed by Tencent, is a business communication and collaboration app. Formerly known as WeChat Work, it offers features like group chat, video conferencing, file sharing, and task management.

It integrates with email, calendar, and CRM systems. It’s popular in China, supports multiple platforms and languages, and allows larger group sizes and more contacts compared to WeChat.

It also enables interaction between WeChat and WeCom users. Certain features may be restricted based on user settings and permissions.

How is it different from WeChat?

WeCom is targeted for business communication needs whereas WeChat can be used to post articles, run ads and get connected with potential customers. Some of the significant differences between these apps are

WeChat allows an individual account to create a group with up to 500 members, while its business equivalent allows up to 10,000 group members for an organizational group and up to 2000 members for other groups. The organization can use it to invite customers, vendors, suppliers, and partners to join its groups for more accessible communication. Similarly, a WeChat account can add up to 5000 “friends,” but an individual WeChat Work account can add up to 50,000 “friends.

Besides, a WeChat account can send up to 200 messages to friends, while the other account has no limit for bulk messages.

Another feature that makes it more business-friendly than WeChat is that professional accounts can share the information of their “friends” (e.g., customers) with other professional members, which makes for seamless work handover or workflow support.

Moreover, these powerful features can be beneficial for business networking as well as operations management. Users of both platforms can interact with each other, as both platforms are developed by Tencent and are integrated with each other. This means that users of WeChat can send messages and make calls to WeCom contacts, and vice versa. Similarly, users of WeCom can also interact with WeChat contacts by adding them to their WeCom contacts list and sending messages or making calls through the app.

Additionally, WeChat Work provides various APIs to allow organizations to access and integrate it with other applications, including those of the WeChat ecosystem and third-party partners.

APIs – Application Programming Interfaces

Tencent provides a range of APIs that developers can use to build custom integrations and extensions for the platform. Here are some of the most popular APIs:

Chat API: This API allows developers to build custom chatbots and integrations for chat feature, enabling users to interact with third-party services and applications directly within the platform.

Directory API: This API provides access to user and group information within, making it easier to manage users, groups, and permissions.

Event API: This API allows developers to receive real-time notifications for various events, such as message send/receive, user login/logout, and group chat creation/deletion.

Contact API: This API allows developers to manage and synchronize contact information between the platform and external systems.

Authentication API: This API provides secure authentication and authorization for third-party applications that need to access features and data.

Drive API: This API enables developers to build custom integrations for cloud storage and file sharing features, allowing users to access and share files directly within the platform.

🌏 Why should brands use CRM Integrations on WeChat?

These are just a few examples of the APIs available for WeCom. Developers can access the full API documentation and resources on the WeCom developer website.

WeCom Usage in China & How Covid-19 Influenced Its Usage

WeCom, Tencent’s dedicated product for business communication and office collaboration, reached 180 million active users with more than 10 million companies and organizations last year.

When Covid-19 hit and everyone was forced to work, tools like WeCom made the transition easy for people to keep up with their work and business. WeCom facilitated remote work and virtual events during the pandemic.

WeCom helped with:

Increased Adoption: As businesses and organisations shifted to remote work and online collaboration, there was a surge in the adoption of WeCom. According to Tencent, the company behind WeCom, the app saw a 200% increase in usage in China during the early stages of the pandemic in 2020.

Hybrid Work Model: As China emerged from the pandemic and returned to work, many businesses adopted a hybrid work model, with employees working both in the office and remotely. WeCom played a key role in facilitating this model, as it allowed employees to communicate and collaborate seamlessly regardless of their physical location.

Virtual Events: With the cancellation of in-person events and conferences, many organisations turned to virtual events to connect with customers and partners. WeCom’s video conferencing and group chat features made it a popular platform for hosting virtual events.

How B2B Brands Can Use WeCom

Customer Support: B2B brands can use WeCom to provide customer support to their clients. They can create a dedicated customer support group within WeCom and allow customers to contact them via chat, voice, or video calls. This can help businesses provide faster and more personalised support to their customers.

Sales and Marketing: B2B brands can use Wecom to communicate with their potential clients and partners. They can create groups and invite prospective clients to join them to provide product information, answer questions, and share marketing collateral. This can help businesses build stronger relationships with potential clients and generate leads.

Collaboration: B2B brands can use Wecom to collaborate with their external partners, vendors, and suppliers. They can create groups and invite external parties to join them for discussions, document sharing, and project management. This can help businesses streamline their supply chain management and enhance collaboration with external parties.

Event Management: B2B brands can use Wecom to manage their events and conferences. They can create groups for attendees, share event schedules, and send notifications to keep attendees informed about the latest updates. This can help businesses enhance the attendee experience and engage with their audience more effectively.

💼WeChat for B2B sector & 10 Ways for a B2B Brand to Generate Leads on WeChat

How B2C Companies Can Use WeCom

WeCom can be used by B2C companies to enhance their communication with customers and improve their overall customer experience. Here are some ways B2C companies can use WeCom:

Customer Service: B2C companies can use WeCom to provide customer service to their customers. They can create a customer service group within WeCom and allow customers to contact them via chat, voice, or video calls. This can help businesses provide faster and more personalised support to their customers.

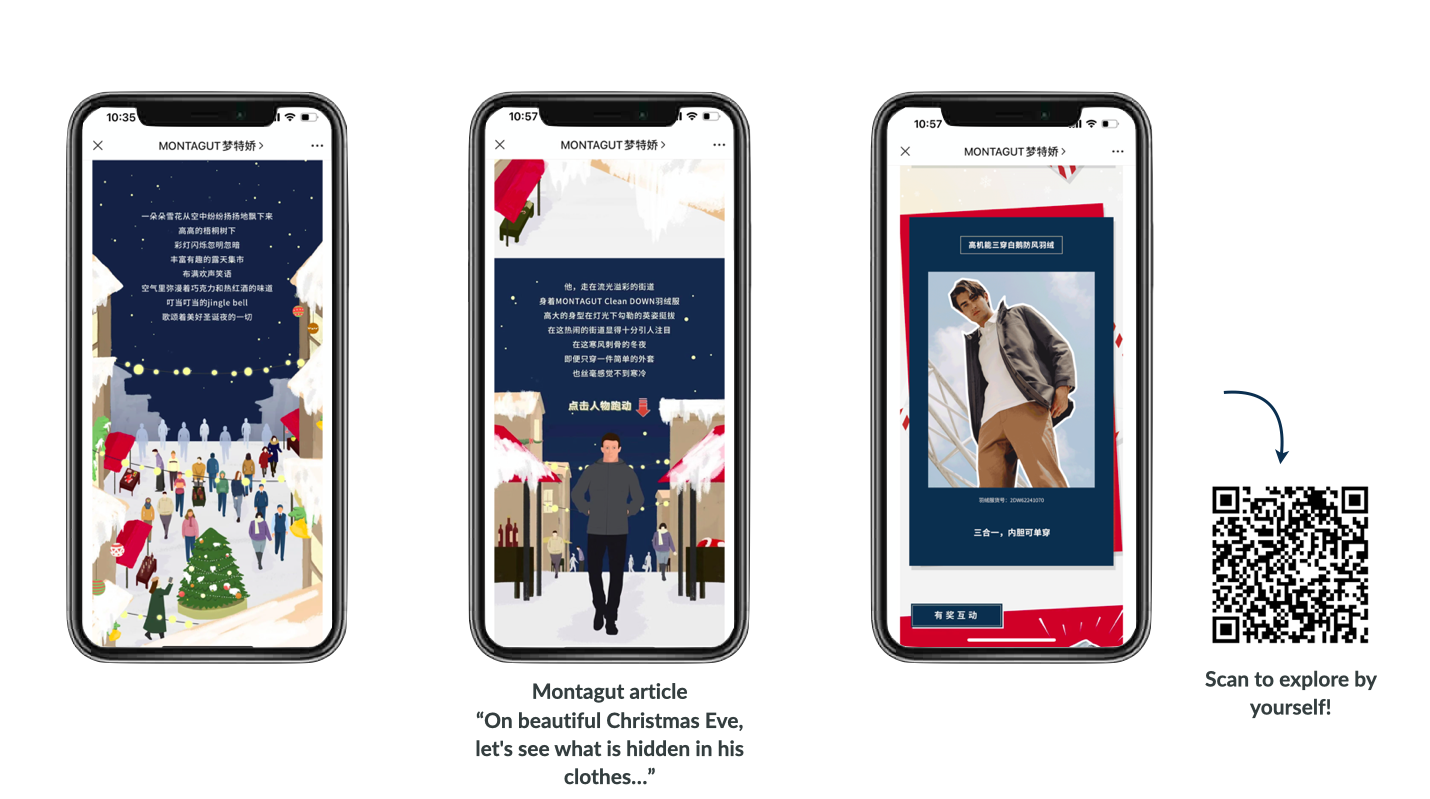

Marketing: B2C companies can use WeCom to promote their products or services and engage with their customers. They can create groups and invite customers to join them for product launches, promotions, and other marketing events. This can help businesses build stronger relationships with their customers and increase customer loyalty.

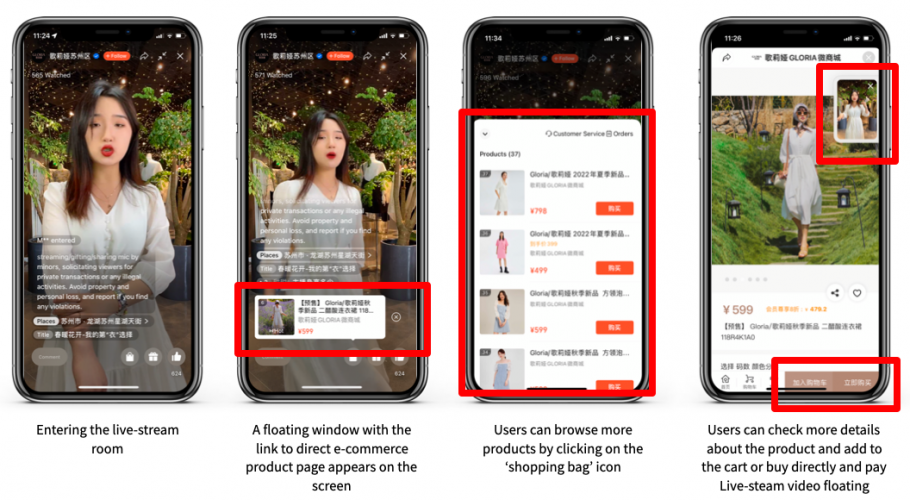

Sales: B2C companies can use WeCom to facilitate sales with their customers. They can create groups and invite customers to join them to provide product information, answer questions, and place orders. This can help businesses enhance their sales processes and provide a more convenient shopping experience for their customers.

Feedback and Surveys: B2C companies can use WeCom to gather feedback and conduct surveys from their customers. They can create groups and invite customers to participate in surveys or provide feedback on their products or services. This can help businesses gain valuable insights into their customers’ needs and preferences and make data-driven decisions.

Overall, WeCom can be a valuable tool for B2C companies to enhance customer communication and engagement. It improves customer service, and increase customer loyalty and satisfaction.

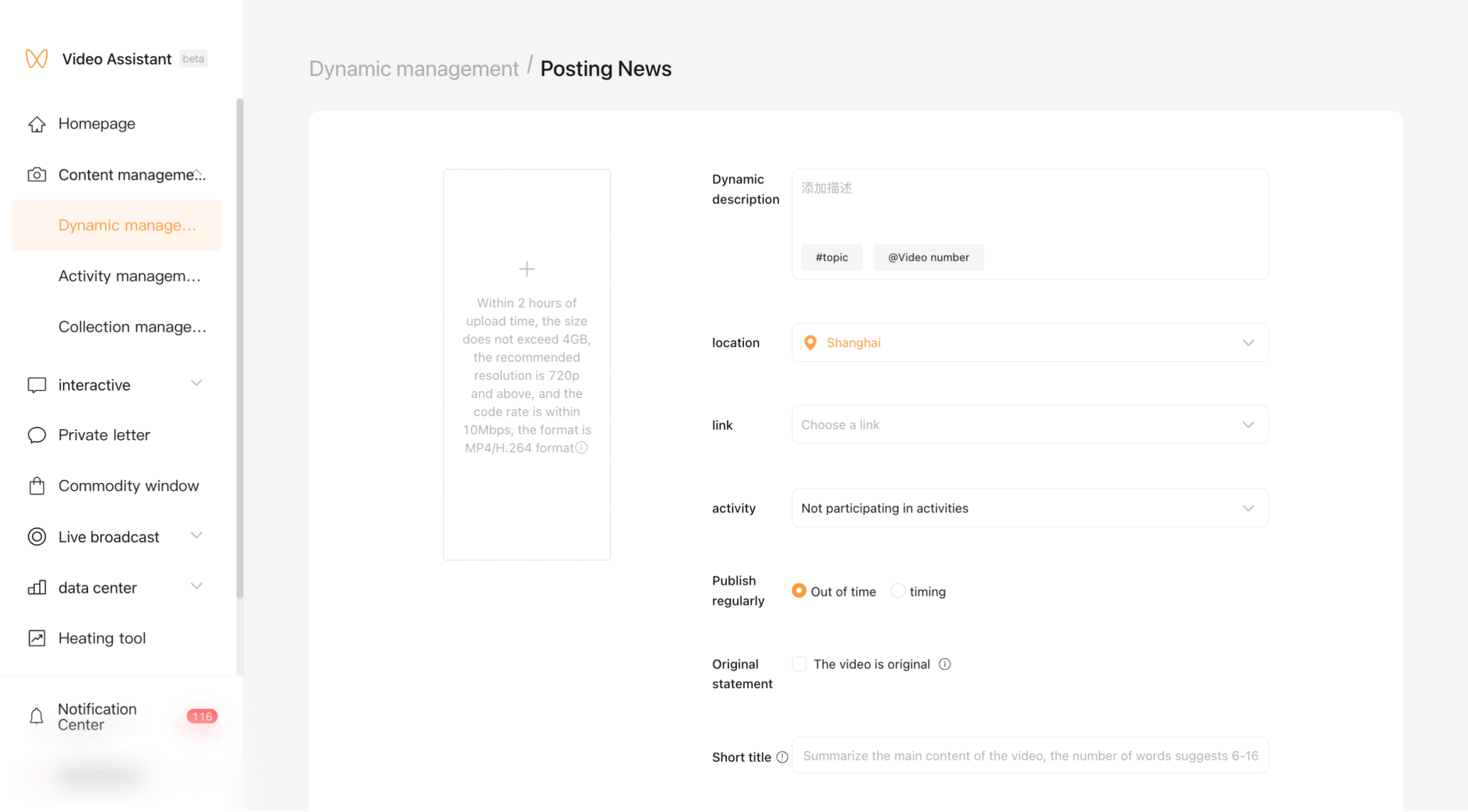

Setting Up WeCom for Your Business

Employers can create a WeCom account by following these steps:

- Firstly, go to the WeCom registration page: https://work.weixin.qq.com/

- Secondly, enter your company information, including company name, industry, and contact information.

- Create an administrator account by entering your email address and creating a password. This account will have full access to your company’s WeCom account and settings.

- Verify your email address by clicking on the verification link sent to your email.

- Set up your company’s WeCom account by following the prompts provided by the platform.

- Once your account is set up, you can invite employees to join by providing their phone numbers and email addresses.

Note that there may be additional steps required for verifying your company’s information and setting up specific features within WeCom, such as third-party integrations or customer support channels. Be sure to consult WeCom’s documentation and support resources for more information on how to customize and optimize your account for your business needs.

🗣️Top 5 alternatives for LinkedIn in China you need to know now

Conclusion

WeCom has revolutionized business communication in China. It provides an efficient and secure platform that empowers organizations to thrive in a fast-paced and interconnected environment. By leveraging the features and capabilities of WeCom, businesses can enhance their productivity. They can also foster collaboration, and build strong relationships, ultimately driving growth and success in the dynamic Chinese market.

If you want to know more about the Chinese market contact our team. We use our knowledge and expertise to help businesses build meaningful partnerships and develop their networks among Chinese customers. For additional information, please contact us at contact@thewechatagency.com.