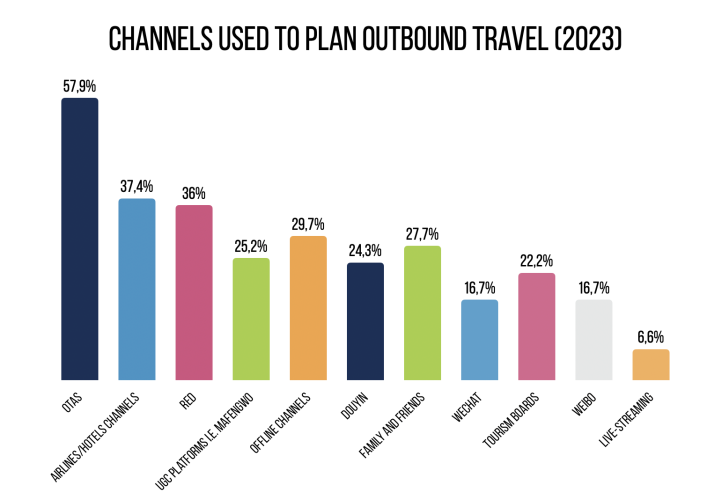

1. Adapting to the new trend? National tourism bureaus are getting on board with Xiaohongshu and Podcasts

-

Australia’s 618 Campaign:

-

The Australia tourism bureau partnered with Xiaohongshu for “Just Rush to Australia on 618,” involving 40 travel brands and offering various travel packages.

-

-

Dubai’s Summer Campaign:

-

Dubai tourism bureau launched “Dubai can also play like this” activities, inviting travel influencers and partnering with local businesses to offer discounts and prizes.

-

-

Singapore’s Theatre Campaign:

-

Following a visa exemption policy, Singapore’s tourism bureau and Xiaohongshu launched “Theatre in Singapore,” featuring an interactive online page and an offline experience space in Shanghai.

-

-

New Zealand’s Xiaohongshu Partnership:

-

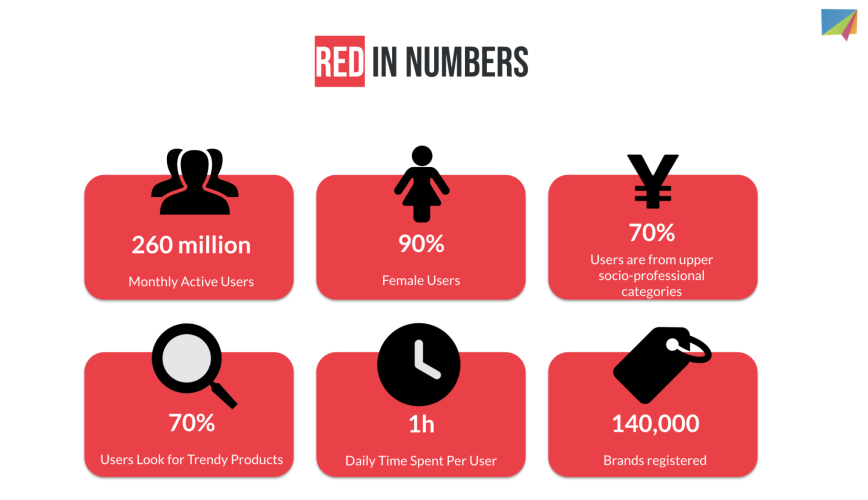

New Zealand’s tourism bureau partnered with Xiaohongshu to engage its 260 million monthly users, aiming to attract tourists and boost economic growth.

-

-

Podcast Collaborations:

-

Tourism bureaus from Spain, Singapore, New Zealand, and South Africa collaborated with Xiaoyuzhou podcasts to promote travel, including Dubai’s podcast series “Dubai Mysteries.”

-

2. China leads the way as social commerce soars globally: McKinsey

-

According to McKinsey & Company’s “State of the Consumer 2024: What’s New and What’s Next” report, China has been at the forefront of this trend for several years, with its market outpacing India’s. Emerging markets such as Brazil, Saudi Arabia, and the UAE are rapidly catching up, with consumers in these regions consistently spending more on social media purchases compared to their counterparts in Europe and the US.

-

McKinsey forecasts that the market will expand to $145 billion by 2027, up from $67 billion today. This growth is primarily driven by Gen Z and millennials, who are four times more likely to make social media purchases than older generations. Over one-third of Gen Z and millennial respondents reported purchasing on social media in the past three months, underscoring the demographic’s pivotal role in driving this trend.

Link:https://jingdaily.com/posts/

3. Xiao Hongshu Presents at VOGUE Business New York Beauty Summit

Xiaohongshu was invited to the “VOGUE Business New York Beauty Summit” in NYC. More than one hundred beauty brand founders, top managers and industry experts attended the venue to dissect the latest trends in the beauty and personal care industry and discuss the development trajectory of this industry.

-

As consumer desires for self-care evolve further, the domestic beauty and hair care market is transitioning from basic functional aspirations to a more diverse and specialized era.

-

Within Xiaohongshu’s 300 million monthly active users, 50% are Generation Z (born in the ‘90s), 35% are Post-Millennials (born after 2000), and 50% reside in Tier 1 and 2 cities.

-

“Beauty Enhancement”, an array of lifestyle activities aimed at beautification, has been pinpointed by Xiaohongshu as being driven by four core elements: “inner drive, personal charm, socializing, and influence”.

-

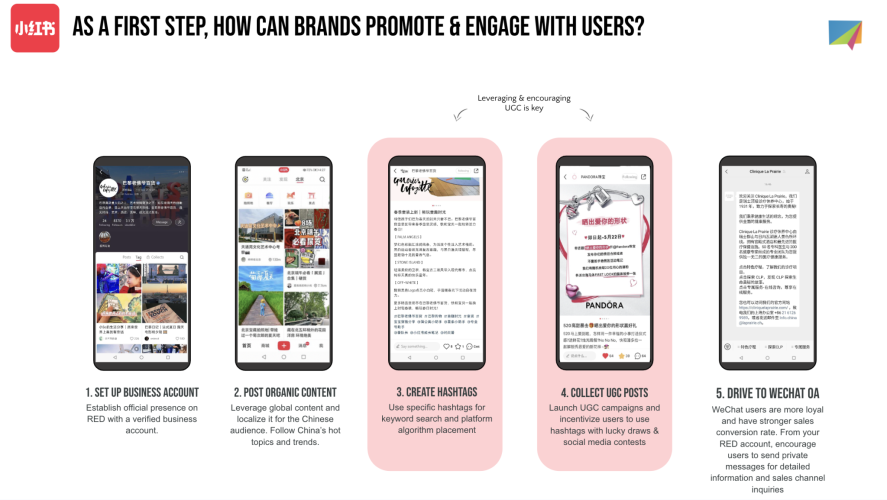

Brands can leverage influencer live broadcasts, store broadcasts, and product related posts, to accelerate the process from user interest to conversion, resulting in direct sales and conversions.

-

Employing KOS, the brands can forge a connection with potential fan base. Deliver specialized content and endorsements to users. Channel online high potential groups to offline stores to experience skin care, sample distribution, gift giving, etc., and complete the offline conversion process. This can also accelerate user purchase decisions.

Link: https://mp.weixin.qq.com/s/

4. WeChat Officially Launches the ‘One-click AI Q&A’ Feature

-

Users of WeChat can now leverage the power of AI directly within the chat thanks to the new “One-click AI Q&A” feature integrated into the app’s input method.

-

Users can ask questions followed by an “=” sign within the chat, and the AI will provide an answer. This functionality is currently available on Windows and Mac versions of WeChat, with the mobile version set to launch soon.

-

In addition to the new AI feature, the WeChat input method boasts other helpful tools to enhance communication.

Link: https://pandaily.com/wechat-

5. 15-year-old Bilibili and its three generations of young audiences

-

On 27 June, Bilibili, China’s equivalent of YouTube, celebrated its 15th anniversary. Chairman and CEO Chen Rui delivered a speech themed “Growing with You” during the anniversary livestream.

-

Bilibili’s user base is dominated by those born in the 1990s and 2000s, accounting for nearly 70% of the total. Currently, the platform boasts 102 million daily active users and 341 million monthly active users, with the average daily usage time being 105 minutes.

-

Users who joined in 2017 have more diversified entertainment preferences, including anime, national creativity, documentaries, and science and technology content. And those who joined in 2022 primarily consume various university courses.

-

Data from Bilibili also shows that over 70 million users research cars on the platform every month, with a 218% year-on-year increase in contributions.

-

Since its inception in 2009, Bilibili has evolved from an early Erciyuan cultural community into a multicultural platform encompassing over 7,000 interest circles.

Link: https://daoinsights.com/news/