iFlytek demonstrates new AI writing tools based on its own language model, claims it outperform ChatGPT

With the release of its own AI language models and associated applications, iFlytek is continuing the contribution of Chinese tech companies to the global AI development initiative sparked by ChatGPT.

An artificial intelligence writing tool called the iFlytek AI Writer aids users in quickly creating articles based on given information and prompts. On May 6, the product had its initial release.

According to the chairman of iFlytek, the model has surpassed ChatGPT in the areas of Chinese long-text generation, medical knowledge, and mathematical prowess but still falls short of ChatGPT in this area.

Three upgrades will be made to the model soon. On June 9, the model will be improved with code and multimodal interaction skills, and on August 15, it will be improved with open-ended question, multi-round dialogue, and mathematical ability capabilities. He added that by October 24 the model will be on par with ChatGPT’s current level in English and surpass ChatGPT’s current level in Chinese.

https://technode.com/2023/05/10/iflytek-demonstrates-new-ai-writing-tools-based-on-its-own-language-model/

Xiaohongshu tests new feature enabling influencers to add shopping links to posts

As part of its push towards e-commerce transactions, Xiaohongshu is enabling a select group of merchants to invite platform influencers to include shopping links when they post recommended content.

Instead of connecting to external e-commerce platforms, the links are directly connected to stores within Xiaohongshu.

In January 2021, the feature was initially accessible to all platform creators, but it was removed six months later due to “unsatisfactory link conversion rates.”

Xiaohongshu, which is frequently compared to Instagram, has been refocusing on e-commerce in recent months. It tested a group-buy feature last month and found success with livestream shopping earlier this year.

https://mp.weixin.qq.com/s/FTb_v-_vYsghkMr454iNtg

LinkedIn to shut China app, cut over 700 jobs

InCareer, the Chinese version of LinkedIn, will shut down its job board in August. Thanks to our strong China-based team, InCareer had some success over the past year, but it also faced stiff competition and a difficult macroeconomic environment.

LinkedIn stated in October 2021 that the Chinese-language version of its services would be discontinued due to “a more difficult operating environment” and “greater compliance requirements.”

Instead, the Microsoft-owned company introduced InCareer, a stand-alone employment app. InCareer had 57 million users as of July 2022 and was linked to 875 million members globally via LinkedIn.

700 employees in China will lose their jobs as a result of InCareer’s decision to change its business strategy and assist Chinese companies with recruiting, marketing, and training personnel abroad.

https://news.linkedin.com/2023/may/a-message-from-linkedin-s-ceo

Dazi culture in RED

Users of Xiaohongshu list the “professional” connections they require to expand their personal social network beyond simple acquaintances.

Recently, the “Dazi Culture” has become a trend on the internet. Finding a partner for a certain activity or pursuit—be it a study partner, a travel companion, a movie buddy, or a workout partner—is central to “Dazi” culture.

“Da Zi” is a colloquial term for a friendship. They do provide a relationship that people are eager to have, especially when you just want someone to eat or shop with but not share your most private secrets with. Despite the fact that they are not close friends.

“Da Zi” may be the reason why young people associate with one another because they have common interests, taste, or preferences.

The “Voice Live” feature, which focuses on voice social networking and lets users create open rooms and have conversations with random people about a variety of topics of interest, was internally tested by Xiaohongshu in October.

In February this year, 小红书 launched a “group chat” function, continuing to break the reality-based social networking model of acquaintances and connecting strangers by interests.

https://mp.weixin.qq.com/s/rWi4TqsjEsMSXrk7uLMtew

Balenciaga gives a nod to sustainability for 520 festival

Balenciaga, a luxury French fashion house, is leveraging Chinese Gen Zers’ growing passion for sustainability in advance of the 520 shopping festival (also known as Internet Valentine’s Day).

Chinese Gen Z consumers’ attention to brands’ social responsibility has emerged as a defining characteristic. With the recent launch of 500 new sustainable products on Tmall Luxury Pavilion, luxury brands have made sure to stay on top of this trend.

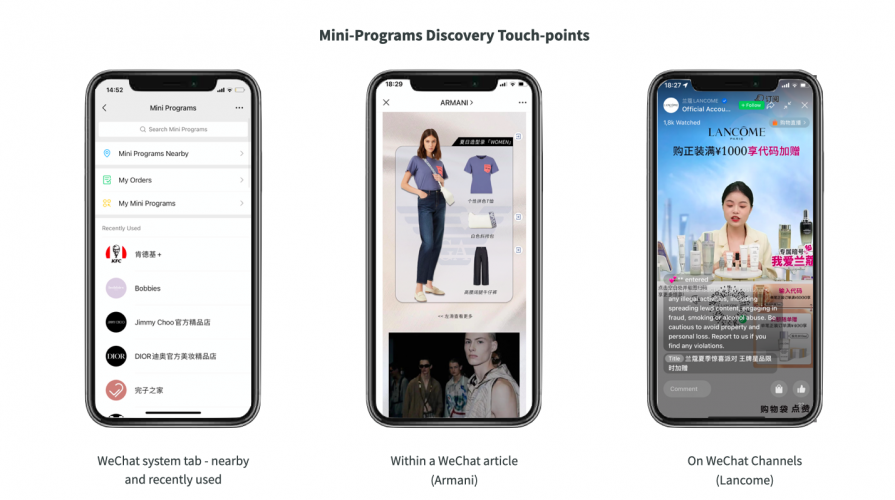

Along with the launch of the line, Balenciaga also published an interactive mini-program on the messaging app WeChat. On the microblogging platform Weibo, as of May 10, the hashtag “Balenciaga 520” had accumulated 17 million views.

Chinese Tourists’ Spending In Europe Rises, But Visitor Numbers Remain Weak

The return of Chinese tourists to foreign countries began closer to home, with Asian locations like Thailand, Japan, South Korea, and Singapore emerging as early favorites, according to data from several Chinese travel agencies. Richer Chinese tourists appear to be among the first to travel back to Europe.

Chinese consumers now pay much more to travel to Europe, and demand is still below pre-pandemic levels. Those who do make these lengthy trips, though, are spending more money than before.

Europe will likely have to wait until the end of 2023 or 2024 to see the return of large-scale Chinese tourism.

https://jingdaily.com/chinese-tourist-europe-spending/

Lancôme spotlights Chinese ceramics in eye cream campaign

For the promotion of its Absolute Eye Cream, Lancôme examined the beauty of conventional Chinese ceramics. The campaign uses the restoration of old objects as a metaphor for rejuvenating sagging or aging skin.

Chinese consumers’ desire for goods that honor their country’s rich cultural heritage, both old and new. Foreign brands can take advantage of this trend with clever product design and local partnerships, making it far from the exclusive domain of domestic brands.

According to the study, half of Chinese women between the ages of 25 and 30 use anti-aging products like skin-lifting creams, serums, and eye creams.

Court Ruling Sparks Debate Over Promoting Work on Social Media

Luxury brands are embracing the concept of “virtual luxury” more and more in order to appeal to younger, digitally savvy consumers who value sustainability and one-of-a-kind experiences. To engage customers and create fresh opportunities for brand interaction, this entails using virtual experiences and products.

But the question still stands: Is authenticity still important in marketing? While virtual luxury might be alluring in the short term, brands shouldn’t discount the value of authenticity and quality when fostering long-term consumer trust and loyalty.

Given these trends, luxury brands should think about how to strike a balance between the advantages of virtual luxury and the requirement to uphold a strong brand identity and reputation. This might entail coming up with inventive ways to combine tangible goods and services with digital ones, all the while upholding the brand’s commitment to excellence and authenticity throughout.

https://www.sixthtone.com/news/1012863

Checking the performance of prior posts within the last 30 days is now possible in the WeChat backend, which is a new data point available.