1.China’s Video Platforms Under Scrutiny Amid New Gov’t Campaign

- The short video market in China has grown significantly; as of June, there were 1.02 billion online short video users, up 14.54 million from December 2022.

- Despite this expansion, the industry faces criticism for widespread dissemination of fabricated content. Content producers frequently create videos that cater to vulgar tastes or share sensationalist news in an effort to increase viewership and profits.

- To address these concerns, Douyin, the Chinese version of TikTok, introduced measures in May requiring content creators to clearly label AI-generated content. This helps users distinguish between virtual and real content.

- Additionally, Weibo, the microblogging platform, initiated a trial of a “side note” function in September, similar to “community notes” on X (formerly Twitter). During this month-long campaign to counter inappropriate content and fake news, verified users can fact-check posts.

- Accounts or platforms found to be in violation face closure and penalties, as issued by the nation’s top internet watchdog.

LINK: https://mp.weixin.qq.com/s/CSDtfyeBj4SGDh37KGr46w

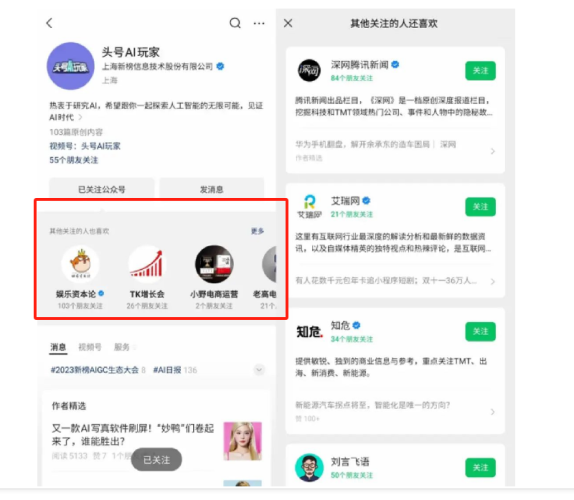

2.WeChat live shopping GMV hits 100 billion RMB

WeChat revealed on 11 December that WeChat’s shopping feature achieved 100 billion (13.9 billion USD) in gross merchandise volume this year.

Even with this remarkable number, sales of the specialized short video apps Douyin and Kuaishou, which are now the preferred online shopping destinations for many Chinese consumers, are still far below this amount. Douyin is expected to surpass Kuaishou’s sales of 800 million RMB (112.4 million USD) this year, with sales of 2 trillion RMB (281 billion USD).

Given that it has already developed a “pretty significant high-income and affluent customer base,” WeChat is now well-positioned to benefit from the expanding market for luxury live shopping. WeChat Channels can hopefully carve out a niche as the go-to destination for luxury live shopping, distinguishing itself from everyman apps Douyin and Kuaishou.

LINK: https://daoinsights.com/news/wechat-live-shopping-gmv-hits-100-billion/

3.China’s Gen Z ‘city walk’ phenomenon is good for brands

- More than sixty percent of city walkers are wealthy, college-educated women in China’s first-tier cities between the ages of eighteen and thirty-five.

- A growing number of lifestyle brands have already collaborated with regional influencers to produce themed city walks that are open to the public as part of their fan community.

- To launch the brand’s newest coloring shade, Honey Light Gold, Schwarzkopf staged a “Color District” parade at Shanghai TX Huaihai Plaza. Taking advantage of the popularity of City Walk, the event brought together 10,000 spectators for the parade to celebrate bold styles and over 100 beauty KOLs.

- Peco, a Chinese designer bag brand, adopted a playful approach with a “Dog Walk Show” on the streets of Shanghai to celebrate its ninth anniversary in late September. The brand styled nine models and dogs to stroll along the streets of Shanghai, with bag straps redesigned into leashes.

- City walk’s resurgence is a uniquely contemporary Chinese phenomenon. The common thread uniting these city walk-related brand events is young people’s desire to get out more on the streets and live more in the moment.

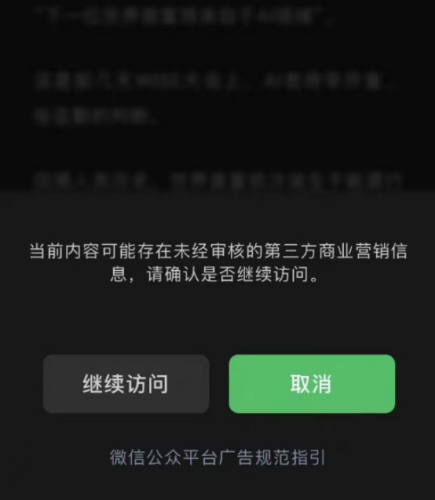

4.Wechat account test marketing content limit pop-up window

Users have been receiving relevant pop-up prompts in some WeChat account articles that contain marketing promotion information. These prompts indicate that the current content may contain unaudited third-party commercial marketing information, and users have the option to either continue reading the article or leave it.

Regarding this, a WeChat representative stated that “the pop-up window function is currently in the testing stage, and it is not a violation that will pop up; instead, the user will be repeatedly reminded and warned, and if the violation stays, the pop-up window will appear.”