China’s fashion landscape is witnessing a profound shift as niche brands and independent luxury lables carve out their space in the hearts and closets of discerning consumers. This trend reflects a broader movement towards individuality, authenticity, and meaningful consumption in one of the world’s largest markets.

The Emergence of Niche Brands

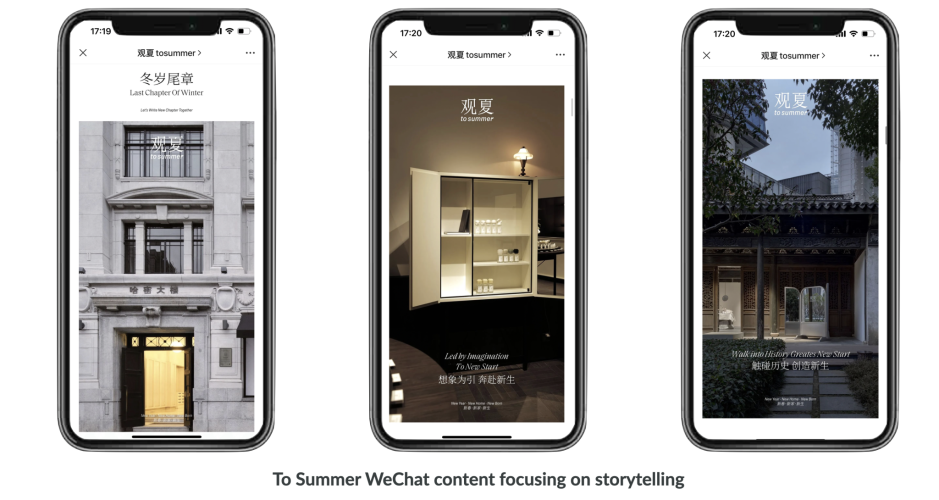

In recent years, a surge of interest has propelled lesser-known brands into the spotlight. Thus challenging the dominance of established luxury houses. Brands like Anya Hindmarch, Brandy Melville, and To Summer are capturing the imagination of Chinese consumers with their distinctive offerings. What sets these labels apart are not just their products but the stories they tell and the experiences they offer.

Consumer Shifts and Preferences

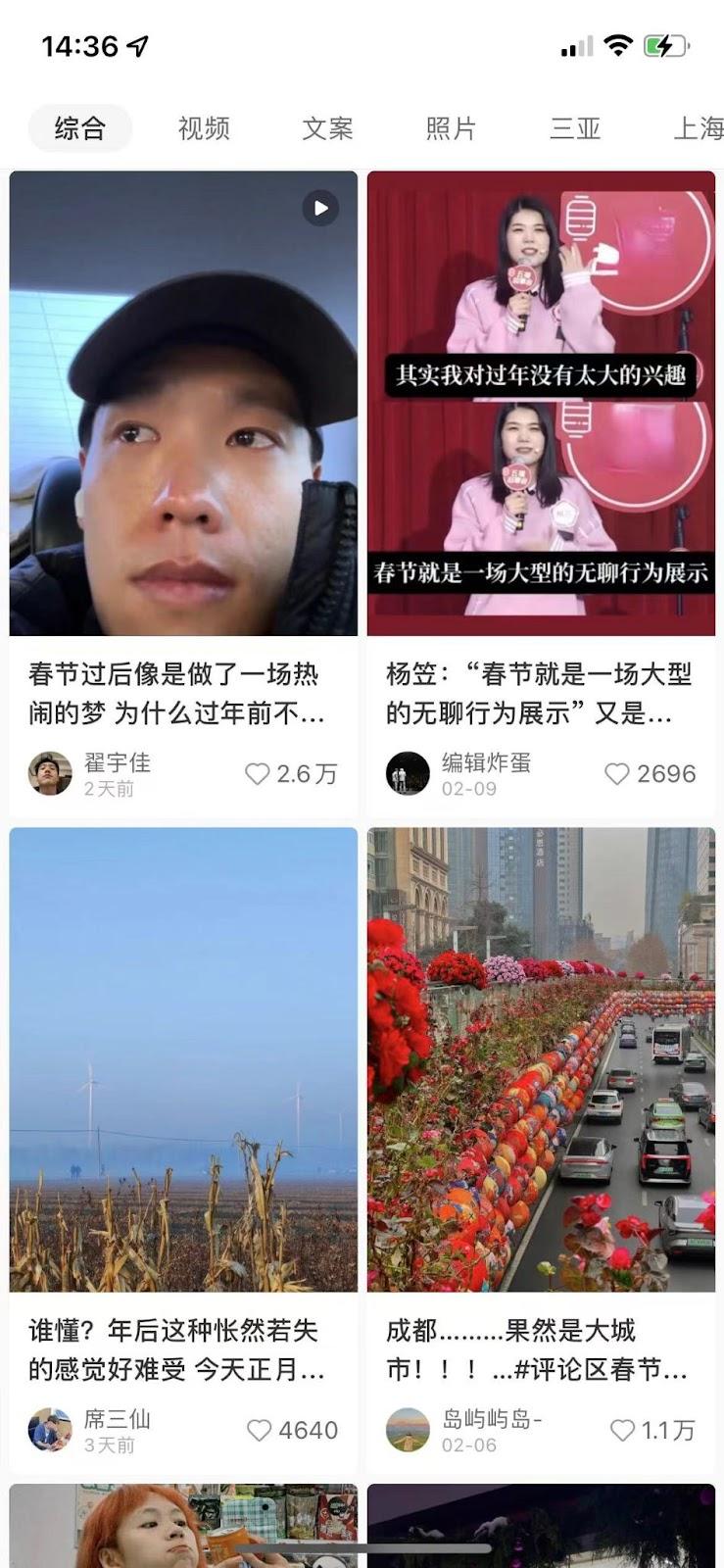

One of the driving forces behind the rise of niche brands is the evolving mindset of consumers, particularly among the younger demographic. Gen Z, in particular, seeks more than just status symbols; they crave authenticity and individual expression. This demographic shift is reshaping the luxury landscape, with consumers increasingly prioritizing design, value, and personal connection over conspicuous branding.

Read more about Gen Z and how to Target Them

The Allure of Niche Brands

The allure of niche brands lies in their ability to offer exclusivity and a sense of belonging to a community of like-minded individuals. These brands go beyond mere products; they curate experiences and foster connections through storytelling, events, and social media engagement. For consumers, niche brands like Vivienne Westwood and Annakiki resonate not just for their designs but for the values they embody.

Sustainability and Mindful Consumption

Furthermore, the COVID-19 pandemic has accelerated changes in consumer behavior, with an increasing emphasis on mindful consumption and sustainability. Brands like Filippa K and Nanushka are capitalizing on this shift by championing sustainable practices and engaging in transparent communication with their audience. Above all, Chinese consumers, renowned for their discernment, are embracing brands that align with their values and beliefs.

Navigating the Chinese Market

The success of niche brands hinges not only on their products. Their ability to navigate the intricacies of the Chinese market is equally important. E-commerce platforms, social media, and strategic partnerships play a pivotal role in amplifying brand visibility and fostering customer engagement. However, entering and thriving in China’s competitive market requires more than just a strong digital presence; it demands a deep understanding of local preferences and cultural nuances.

Top Chinese E-commerce Platforms and Entry Fees

Adapting Strategies

In response to these changing dynamics, established luxury houses are also recalibrating strategies to embrace the rise of niche brands. Brands like Louis Vuitton are tapping into the demand for limited editions and immersive experiences. These kind of tactics cater to the evolving tastes of Chinese consumers.

Selling On WeChat: How Brands Can Do and Is it Better Than Other E-commerce Platforms?

Future Outlook

Looking ahead, the trajectory of niche brands in China appears promising, driven by a growing appetite for authenticity and individuality. As consumers continue to seek out brands that resonate with their values, the market is ripe for further innovation and disruption. With the right blend of creativity, authenticity, and strategic foresight, niche brands are poised to leave an indelible mark on China’s dynamic fashion landscape.

In conclusion, the rise of niche brands in mainland China signals a profound shift in consumer preferences and market dynamics. As the pursuit of authenticity and individuality takes center stage, brands that embody these values are redefining the notion of luxury. They are also the ones reshaping the fashion industry’s future in China and beyond.

If you wish to know more about marketing in China, please contact our team. We use our knowledge and expertise to help businesses build meaningful partnerships and develop their network among Chinese customers. For additional information, please contact at contact@thewechatagency.com.