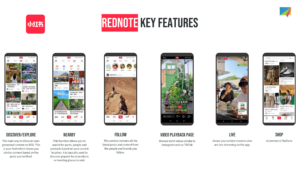

For foreign brands entering the Chinese market, discussions around digital marketing often focus on the latest trending platforms like Douyin and Xiaohongshu (RED). While these channels generate significant buzz, WeChat remains the most critical and enduring digital platform in China.

Despite not always being in the spotlight, WeChat continues to be the country’s most widely used app and an indispensable tool for brands aiming to build lasting relationships with consumers. Unlike major e-commerce marketplaces such as Tmall and JD, which demand high advertising spend and platform commissions, WeChat provides brands with a lower-cost alternative for customer acquisition, direct engagement, and complete ownership of consumer data.

WeChat: More Than Just a Messaging App

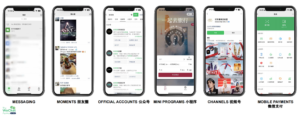

Originally launched as a messaging app, WeChat has transformed into an all-encompassing digital ecosystem, offering brands multiple avenues to engage consumers:

- Official Accounts – A powerful tool that functions like a combination of a website, blog, and email marketing system, enabling brands to share content, interact with users, and build a loyal community.

- Mini Programs – Embedded apps within WeChat that provide seamless e-commerce, customer service, and loyalty features without requiring users to leave the platform.

- WeChat Pay – An essential mobile payment system that dominates China’s cashless economy.

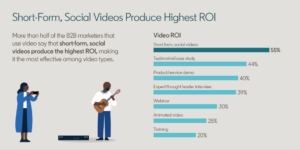

- WeChat Channels – A short video and livestreaming feature that competes with Douyin and Kuaishou, offering brands an opportunity to engage users organically.

- WeChat Groups – Exclusive communities where brands can foster deeper engagement and collect valuable consumer insights.

This extensive ecosystem enables users to consume content, interact with brands, and complete purchases all within a single platform, making WeChat an indispensable tool for digital commerce in China.

WeChat as a Digital Storefront for Brands

Unlike in Western markets, where consumers typically turn to Google or a company’s website for brand information, Chinese consumers often search directly on WeChat. This makes WeChat the go-to platform for discovering brands, learning about products, and engaging with customer service.

For many businesses, WeChat effectively replaces the need for a traditional website. However, many foreign brands underutilize their WeChat presence, with outdated content, inactive accounts, and broken links reducing engagement. Keeping a WeChat Official Account updated and interactive is as important as maintaining a website in other markets.

A Fully Owned Channel for Brands

One of the biggest challenges for brands operating in China is balancing the high cost of customer acquisition with long-term retention. Unlike Tmall, JD, and Douyin, where brands must constantly pay for visibility, WeChat allows businesses to build and nurture their own audience. This offers several advantages:

- Lower Customer Acquisition Costs – WeChat provides a cost-effective alternative to traditional e-commerce platforms, where brands must bid for visibility.

- Full Data Ownership – Unlike marketplaces that control customer data, WeChat enables brands to collect and analyze user interactions directly.

- Seamless Omnichannel Integration – WeChat bridges online and offline engagement, making it easier to connect with consumers across multiple touchpoints.

For brands looking for a long-term, cost-efficient strategy in China, WeChat presents a powerful direct-to-consumer (D2C) model.

WeChat’s E-commerce Evolution

While platforms like Douyin and RED attract attention with viral trends, Tencent has been steadily enhancing WeChat’s e-commerce capabilities. WeChat Channels has emerged as a significant competitor to Douyin’s short video and livestream shopping ecosystem.

WeChat has streamlined merchant onboarding, simplified the sales process, and expanded commerce features to allow product purchases across multiple touchpoints—including posts, search, chat, and even gifting features. These improvements have led to substantial growth:

- A 3x increase in active sellers last year

- A 200% surge in total sales volume

This growth signals that more merchants are seeking sustainable alternatives to traditional e-commerce marketplaces and that consumers are increasingly shopping within the WeChat ecosystem.

Where Should Brands Focus?

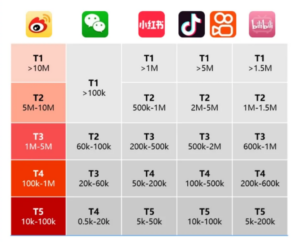

Many international brands question whether WeChat should be prioritized over newer platforms like Douyin and RED or traditional marketplaces like Tmall. The answer depends on a brand’s objectives:

- Douyin & RED – Best for brand awareness, viral content, and impulse-driven sales.

- Tmall & JD – Ideal for reaching high-intent shoppers and providing an official retail presence.

- WeChat – Most effective for fostering long-term engagement, driving repeat purchases, and building brand loyalty.

A well-rounded China digital strategy should leverage multiple platforms, utilizing each one’s strengths to target consumers at different stages of their journey. WeChat remains a key pillar of this strategy, particularly for brands looking to develop a sustainable, direct-to-consumer business model.

Leverage WeChat for Sustainable Growth in China

Navigating China’s complex digital landscape requires a tailored approach. Whether you’re looking to enhance your WeChat strategy or integrate it into a broader digital marketing plan, our team can help you optimize your presence and drive results.

Contact us today to explore how WeChat can support your brand’s long-term success in China.