As the digital media ecosystem in China continues to evolve at an unprecedented pace, understanding emerging trends is crucial for brands looking to thrive in this competitive market. Starcom, the media arm of Publicis Groupe, recently released its latest report, “Increased Integration and Depth in China Media Market”, identifying seven pivotal trends that are redefining consumer behavior, content distribution, and brand strategy across platforms. Here’s a breakdown of the most important insights and how brands can prepare.

1. Cross-Platform Integration: Breaking the Walls Down

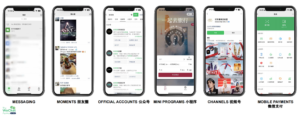

China’s once siloed internet ecosystem is transforming into a landscape of collaboration. In 2025, we’re witnessing platforms like Tencent and Alibaba opening up to one another: Tencent Games content appears on Douyin, Taobao accepts WeChat Pay, and JD.com integrates Alipay.

For brands, this “horizontal integration” means smoother customer journeys and opportunities to execute truly omnichannel strategies. Cross-platform compatibility also improves user experience, leading to better engagement and conversion rates.

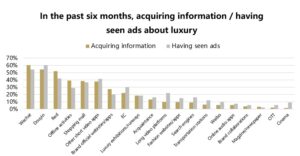

2. AI-Powered Search and Intelligent Interactions

Search is no longer just about users looking for information. With generative AI entering the scene, proactive content delivery and conversational search are reshaping digital marketing. The search engine market in China is expected to surpass RMB 300 billion by 2029, with mobile-based search playing a major role.

Brands must rethink their search marketing by aligning keywords, content, and SEO strategy with evolving AI-driven behaviors across Baidu, Douyin, Xiaohongshu, and other platforms.

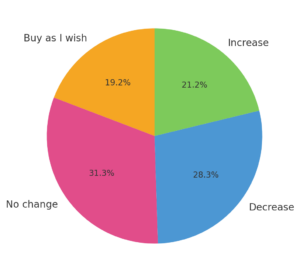

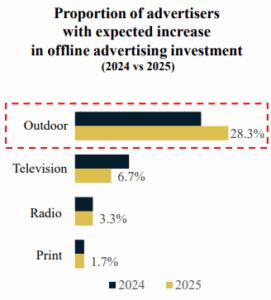

3. Online and Offline Synergy: The New O2O Loop

Marketers are rediscovering the power of offline media, especially when amplified by digital interactivity. In 2025, 28.3% of advertisers are increasing their offline ad spend. Campaigns like Xiaohongshu’s user-generated content (UGC) billboards and McDonald’s programmatic subway ads show how to turn physical placements into interactive, trackable experiences.

Successful brands are integrating data capture tools, experience design, and social buzz triggers into their O2O campaigns to drive conversion.

4. Social-Powered Closed-Loop Commerce

Social media platforms are becoming e-commerce ecosystems. Xiaohongshu leads the way with interest-based group chats, offering exclusive promotions, live previews, and direct links to virtual stores. The results are impressive: 2.5x higher repurchase rates and 300x better conversion rates in private domains.

Brands must build community-focused strategies and activate users through content that fuels interaction and loyalty.

5. Value-Driven E-Commerce Over Price Wars

As consumer preferences shift from discounts to experience, platforms like Taobao and JD.com are focusing on enhancing logistics, customer service, and product quality. Features like Taobao’s hourly purchase service and JD.com’s “24-hour delivery in counties and towns” reflect this evolution.

To remain competitive, brands should deliver value through exclusive products, flexible services, and premium experiences instead of relying solely on low prices.

6. Diverse Content Channels: From Podcasts to Micro-Dramas

China’s content landscape is rapidly diversifying. Podcasts now reach over 220 million users, with 71.6% influenced to make purchases. Meanwhile, micro-drama users account for more than half of the internet population, with the market expected to grow 35% year-on-year to reach RMB 50.44 billion.

Brands need to leverage these formats to tell compelling stories, connect with niche audiences, and reinforce product relevance in immersive, culturally attuned ways.

7. AI’s Expanding Role Across the Funnel

AI is no longer a backend tool; it’s front and center. From predictive CRM and personalized content generation to dynamic bidding and campaign automation, AI is transforming the entire marketing stack. China is also exploring frontier technologies like brain-computer interface advertising.

Brands must embrace AI to improve media planning, content production, customer segmentation, and real-time campaign optimization.

Conclusion: Be Adaptive, Be Integrated, Be Smart

In today’s media landscape, success is no longer about mastering one channel or trend. It’s about understanding how technology, platforms, and content work together to shape consumer expectations.

By staying ahead of these seven trends, brands can craft adaptive, AI-enhanced, and experience-driven strategies that resonate in the ever-shifting Chinese digital ecosystem.

Need help navigating China’s evolving media landscape? Contact our team to explore how we can localize your strategy, enhance your platform presence, and drive smarter, performance-driven campaigns tailored to the China market.