Weixin, which means micro message in Mandarin, was the name given to WeChat when it first debuted in 2011. It began as a simple communication programme, essentially a Chinese equivalent to WhatsApp, as its name suggests. The platform was developed and owned by Tencent, a Chinese internet giant and one of the world’s most valuable firms.

WeChat began as a simple messaging network, but it has evolved into much more. WeChat has basically become the home screen for many Chinese smartphone users thanks to its mini programmes platform, which allows almost any operation to be accomplished from within the app.

That being said, if you want to extend your business into the Chinese market, you’ll need a strategy that centres mostly around WeChat marketing, with an emphasis on WeChat users.

Here are some interesting WeChat statistics to help you see how powerful this platform really is. After all, there’s nothing like hard evidence, right?

WeChat: Active Users

WeChat has a monthly active user base of about 1.225 billion people.

Since its release in January 2011, it has grown by leaps and bounds. It evolved to become an important aspect of people’s lives, allowing them to communicate with friends and family via text messages, voice conversations, and video calls.

The aggregate monthly active users of Weixin and WeChat reached 1.225 billion in December 2020, up 5% year on year. Every day, 45 billion messages are sent and received on WeChat.

WeChat: User Demographics

Almost 40% of WeChat users are between the ages of 25 and 35 years old. Females account for 42.8% of users, while males account for 57.2%.

25 % of WeChat users in China are between the ages of 25 and 30, while another 13.8 % are between the ages of 31 and 35. Users under the age of 24 make up the greatest age demographic (33.5 %).

This is closely followed by users over the age of 41, who account for 19.1% of the total. If your company caters to these demographics, WeChat marketing could be very helpful to you.

WeChat Pay & Mini Programs Stats

WeChat Pay is used by 87% of Chinese consumers to make online payments and WeChat Mini Programs are used by almost 400 million people every day.

WeChat Pay is the second most popular online payment service in China, trailing only Alipay. Men and women make up an equal number of users, and the majority of its consumers (34%) are between the ages of 25 and 34, with the second-largest sector (28%) being between the ages of 35 and 44.

More than 400 million people utilise Mini Programs on a regular basis, resulting in total sales (GMV) more than double in 2020. In addition, the average number of Mini Programs utilised per user climbed by 25% year over year, and the average transaction value increased by 67%.

WeChat: Market Share

WeChat probably accounts for 10-15% of the social media market, with over 1 billion active users. WeChat, on the other hand, is arguably the most popular social site in China, accounting for 34% of the country’s total data traffic

No other app in the world has this level of dominance in such a big market. In comparison, Facebook accounts for only 14.1% of North American traffic. In China, WeChat accounts for more than double that.

WeChat: Revenue

WeChat made 108.2 billion RMB in sales in 2020. In 2019, they received 82.3 billion RMB, compared to 72.7 billion RMB in 2018.

The 2021 stats for WeChat’s revenue is yet to be released, but with their constant innovation, its revenue is expected to rise again. This year, the Chinese messenger’s mini-programs facilitated 1.6 trillion RMB in annual transactions. If the increase in revenue attributed to their mini-programs is any indicator, they’ve had a fantastic year.

The Future of WeChat

WeChat will certainly be successful in China and will continue to expand. WeChat’s penetration rate in Western countries is expected to rise as well outside of the country. COVID-19 has hindered WeChat’s growth because of travel restrictions that prevent Chinese tourists from visiting. However, once the pandemic has passed, WeChat, particularly WeChat Pay, is likely to make a more serious foray into foreign markets.

In fact, Europe has been identified as a crucial growth region. WeChat Pay had been popular among businesses that serve Chinese tourists prior to the outbreak. As a result, the number of merchants accepting WeChat Pay in Europe climbed by 3.5% in 2019. Around 11% of Chinese overseas tourism was spent in Europe.

Conclusion

The stats presented above is rather remarkable and demonstrate how strong WeChat has proven to be. So, if you haven’t already considered incorporating it into your entire marketing strategy, now is the time to do so.

If you require further support with setting up your account please contact our team. We use our knowledge and expertise to help businesses build meaningful partnerships and develop their network among Chinese customers. For additional information, please contact us by phone – Shanghai or Hong Kong

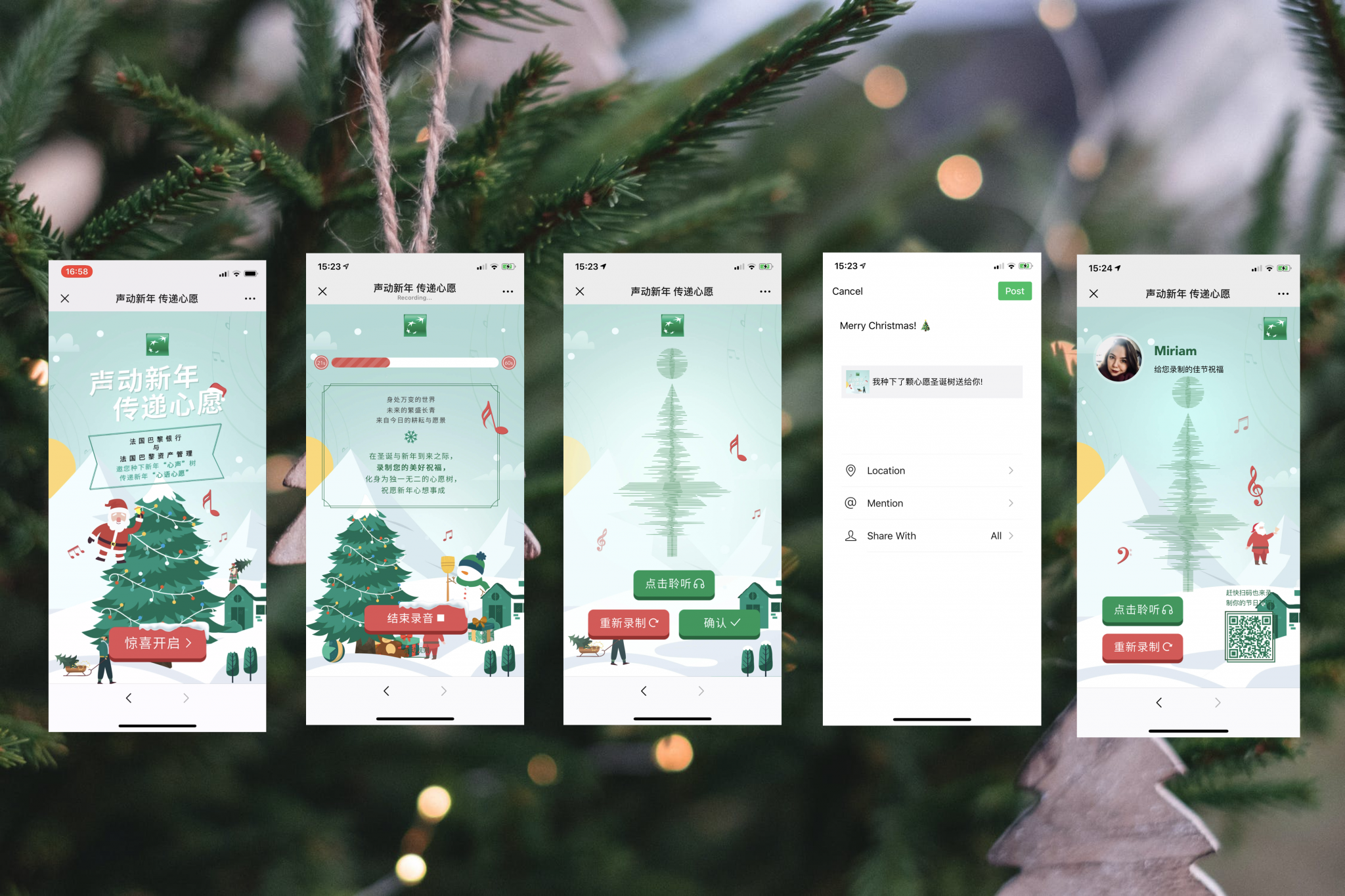

5. KRDS x AkzoNobel – WeChat Article Greeting

5. KRDS x AkzoNobel – WeChat Article Greeting 6. Other Clients

6. Other Clients