China’s social media landscape is undergoing a massive AI-driven transformation, redefining how brands connect with consumers. Platforms like WeChat, Douyin, RedNote (Xiaohongshu), Kuaishou, Weibo, and Bilibili are rapidly integrating AI-powered features to reshape content creation, user engagement, and personalized recommendations.

For brands entering China, understanding these shifts is essential to unlocking new growth opportunities.

AI-Powered Content Creation

AI tools are streamlining content production across major platforms, making it easier than ever for brands and creators to generate engaging, high-quality posts:

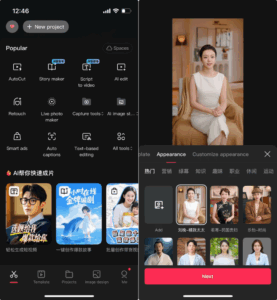

- Douyin & Kuaishou

- Douyin’s CapCut app leverages AI auto-editing, script generation, and AI avatars to simplify video creation.

- Kuaishou’s Kling AI 2.0 enables text-to-video and image-to-video generation, producing cinematic-quality content at scale.

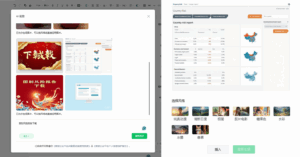

- WeChat Official Accounts

Built-in AI image generation lets editors create visuals instantly in multiple ratios, enhancing article performance.

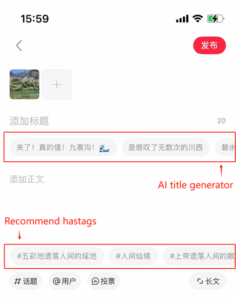

- RedNote AI Tools

RedNote’s AI title generator suggests SEO-optimized headlines using trending keywords to improve reach and engagement.

- AI in Advertising

Platforms like WeChat Ads and RedNote Juguang Ads deploy AI-generated ad copy and visuals via Tencent’s Hunyuan and DeepSeek-R1, optimizing creatives for different audience segments.

Intelligent Social Interactions

Chinese social apps are transforming user engagement with AI assistants and personalized interactions:

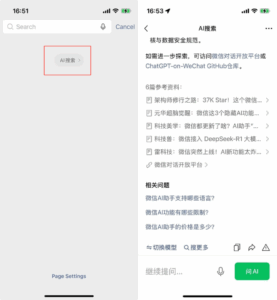

- AI Chatbots

Tencent’s Yuanbao and Douyin’s Doubao integrate directly into chat interfaces, providing real-time recommendations, Q&A, and emotional support.

- 24/7 AI Brand Avatars

Douyin’s upcoming “V Project” will let brands deploy AI-powered digital ambassadors to engage users around the clock.

- Smart Commenting

RedNote DianDian and Weibo’s Luobote automatically generate conversational, context-relevant comments to increase post engagement.

- Real-Time Translations

WeChat, RedNote, and Weibo now support AI-powered multilingual communication, enabling brands to connect seamlessly with global audiences.

AI-Enhanced Search & Discovery

AI is transforming how users search, discover, and engage with content:

- WeChat, Weibo & Bilibili use DeepSeek-R1 to improve multimodal search, integrating text, images, and video for precise recommendations.

- Douyin AI Search leverages Doubao to provide personalized video suggestions based on user behavior.

- RedNote DianDian AI delivers instant lifestyle recommendations by referencing top influencer content — for example, suggesting graduation outfit ideas curated from fashion KOLs.

Why This Matters for Brands

AI integration is changing China’s digital marketing game:

- More Efficient Content Creation → Shorter production cycles, higher-quality outputs

- Hyper-Personalized Experiences → Customized interactions to match evolving consumer needs

- Better Performance Tracking → AI-generated insights to optimize campaigns

By leveraging these AI-driven tools, brands can enhance storytelling, improve campaign ROI, and strengthen community engagement.

Want to harness AI-powered marketing in China? Our team specializes in social media strategy, AI-driven campaigns, and localized content creation tailored to Chinese platforms. Contact us today to discuss how we can help your brand thrive!