As China’s digital economy continues to evolve, so do the expectations, behaviors, and preferences of its consumers. From tech-savvy seniors to Gen Z trendsetters, a nuanced understanding of the country’s most prominent consumer groups is crucial for any brand looking to succeed in this market.

In this blog, we spotlight six key Chinese consumer profiles worth watching in 2025 and share practical tips for how brands can connect with them through localized, data-driven strategies.

-

Elderly Consumers: China’s Silver Tech Boom

With over 280 million internet users aged 60 and above, China’s senior segment now makes up more than 10% of the nation’s online population. These older users are increasingly comfortable with digital tools and are rapidly expanding their online spending. JD.com has reported a staggering 238% increase in purchases made by seniors since 2019.

What They Spend On:

- Travel and leisure

- Health supplements and wellness services

- Comfortable lifestyle products

How to Engage Them:

- Simplify UX design for mobile apps and websites

- Focus on credibility, safety, and product quality

- Leverage family-centric storytelling and value-driven campaigns

-

Gen Z: Experience Over Possession

China’s Gen Z shoppers, born between 1995 and 2010, are digital natives who value emotional connections, creativity, and instant gratification. According to recent studies, 47% of Gen Zers in China say they shop on impulse, often influenced by social trends and peer recommendations.

What They Spend On:

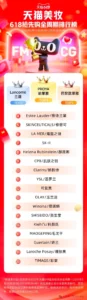

- Fashion and beauty

- Niche hobbies and pop culture merchandise

- Experiential consumption: concerts, travel, co-branded items

How to Engage Them:

- Use Xiaohongshu, Douyin, and Bilibili for trend-based content

- Build buzz through KOL campaigns and interest-based communities

- Prioritize UGC, livestreams, and viral challenges

-

Family Travel Planners: Smart Spending, Digital Tools

From parents organizing summer vacations to adult children planning trips for elderly relatives, family travel planners are strategic, digital-first consumers. They rely heavily on online travel agencies (OTAs) like Trip.com (Ctrip), Qunar, and Fliggy.

What They Spend On:

- Group travel packages and multi-generational experiences

- Convenience-oriented services like airport transfers and visa processing

- Family-focused hotels and entertainment

How to Engage Them:

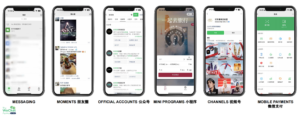

- Use WeChat Mini Programs for itinerary customization

- Work with travel influencers to share itineraries

- Create bundled experiences and early-bird booking discounts

-

Brand-Conscious Millennials: Value-Driven Consumers

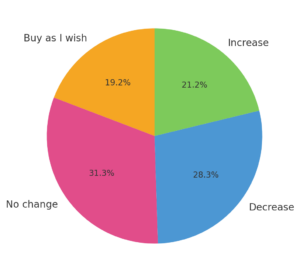

No longer chasing luxury logos, Chinese millennials (aged 28–40) prioritize value, quality, and alignment with their personal identity. With many living in dual-income households, this group commands high purchasing power.

What They Spend On:

- Wellness and fitness

- Premium but functional fashion

- Modern home goods and technology

How to Engage Them:

- Showcase sustainability, authenticity, and innovation

- Use storytelling and brand purpose to foster loyalty

- Offer product reviews and rich content to support informed decisions

-

High-Income Baby Boomers: Wellness and World Travel

This segment, often retired professionals and entrepreneurs, has significant disposable income and time to spend. Whether it’s international trips or wellness investments, they’re looking to enjoy life’s second act to the fullest.

What They Spend On:

- Global luxury travel

- Health checks and spa treatments

- Educational and cultural experiences

How to Engage Them:

- Highlight exclusivity and comfort

- Use direct-response campaigns with trusted media partners

- Provide concierge-level service and personalized offerings

-

Affluent Female Shoppers: Driving the “She Economy”

Women in Tier 1 and 2 cities now dominate household spending decisions. Educated, career-oriented, and financially independent, they prioritize self-investment and high-end lifestyle choices.

What They Spend On:

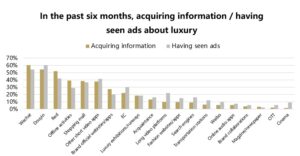

- Designer fashion and beauty products

- Luxury travel and fine dining

- Pet care, wellness, and fitness subscriptions

How to Engage Them:

- Curate premium content and product lines

- Offer VIP programs and early access exclusives

- Celebrate empowerment and self-expression in campaigns

Final Thoughts

Understanding China’s evolving consumer landscape isn’t just about identifying who’s spending – it’s about understanding why they spend, what motivates them, and where they engage. These six audience segments are leading the shift in China’s digital ecosystem. Tailoring your content, messaging, and media strategy to resonate with them can unlock long-term growth and brand loyalty.

Need help localizing your brand for China? Our team specializes in cross-platform strategy, social commerce activation, and KOL-driven campaigns. Get in touch to learn more.