Singles’ Day 2023: Retailers pursue low-priced strategies in hopes of consumers opening wallets

- Chinese e-commerce companies are vying with one another to offer customers tempting discounts on Singles’ Day this year. However, the nation’s largest online shopping event has gradually lost its shine as promoting low prices has evolved into a yearly marketing tactic for companies that are having trouble reviving customer sentiment.

- As the 11.11 pre-sale period begins, up-and-coming retailers like Douyin and Kuaishou, as well as more established competitors like Alibaba and JD, are resorting to offering direct discounts to customers. This is because they still believe that the massive event will motivate customers to divulge their personal information and open their wallets, particularly in light of China’s uneven economic recovery.

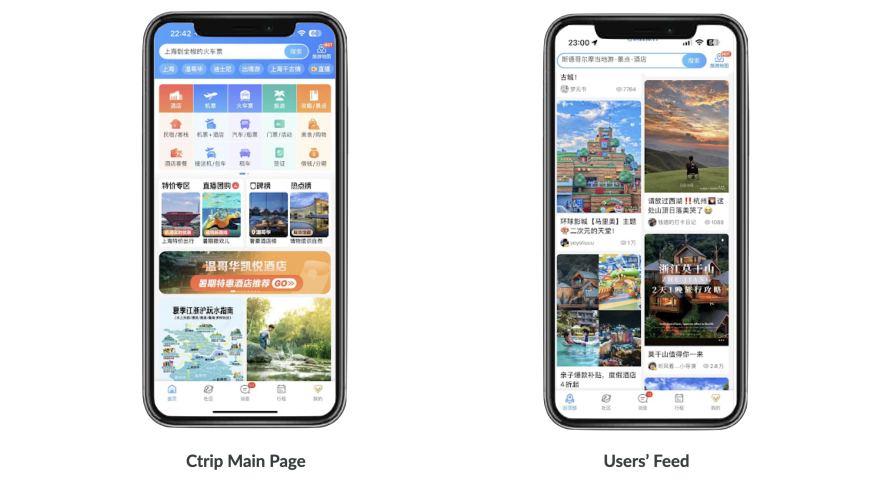

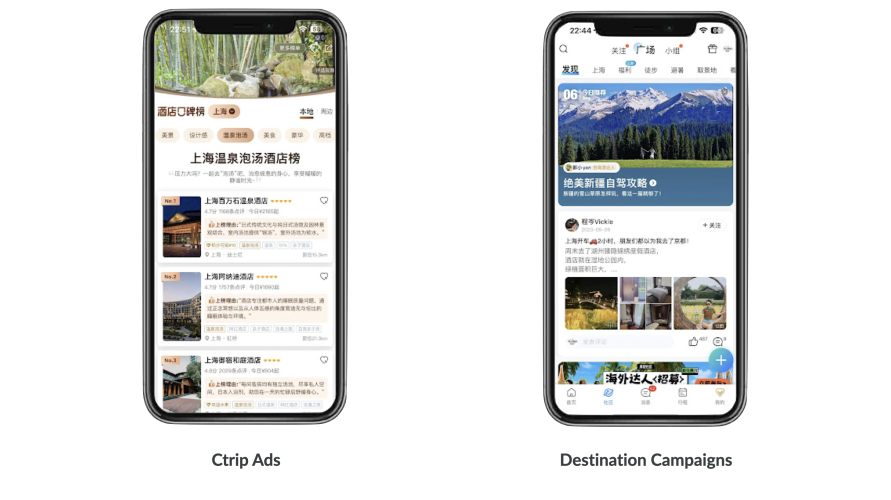

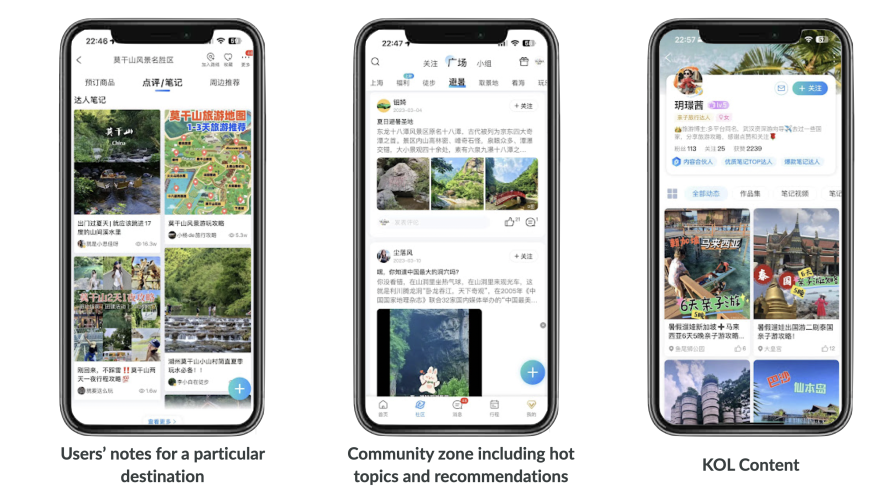

Ctrip introduces a feature for booking restaurants abroad.

In addition, Ctrip announced that it will be in the Ctrip App and overseas version of Trip.com simultaneously online overseas restaurant booking function. The first phase covers more than 6000 restaurants in more than 1000 cities around the world. The Ctrip Group global partner summit was recently held in Singapore on October 26. During the meeting, the 2023 Ctrip Food Forest “global restaurant selection list” was released for Paris, New York, London, and other 24 cities overseas.

Taobao uses an AI shopping assistant to prepare for Double 11.

For the first time this year, AI will be assisting Double 11 bargain hunters. Taobao Wenwen, Taobao’s integrated AI model, uses text understanding and generative capabilities to respond to user queries.

- As part of the Double 11 special promotional period, the AI shopping assistant will combine product information with tips on the best discounts, giving shoppers added confidence in their decision-making.

- The intention is to retain users who visit Taobao exclusively and discourage them from using Xiaohongshu, Baidu, and Douyin for recommendation-seeking purposes.

- Other online reviews note that the recommendations given by the AI assistant sometimes do not correspond to the question asked and that the overall quality and coherence of the content need to be improved.

- Taobao Wenwen’s user base is currently only 5 million, and many more will be required to train it before it can rival Xiaohongshu’s 190 million monthly active users as a reliable sidekick.

LINK: https://daoinsights.com/news/taobao-gears-up-for-double-11-with-ai-shopping-assistant/

What Brands Should Know About Singles’ Day 2023: China’s Version of “Black Friday”

- Value innovation, or pursuing low cost and differentiation simultaneously, is this year’s winning Singles’ Day tactic for the luxury market.

- Value lies in thoughtful packages supported by persuasive marketing narratives rather than aggressive pricing.

- Discerning Chinese luxury consumers at a shopping festival will accept paying less for the same value or paying the same for more value.

- AI improvements to customer interactions are being introduced in this year’s festival. It makes wiser purchasing decisions possible by deciphering intricate discount combinations.

LINK:https://jingdaily.com/chinas-black-friday-is-here-what-brands-need-to-know-about-singles-day-2023/

Internet addiction: China rolls out most comprehensive regulations yet

- The regulations, which go into effect on January 1, 2024, ask technology companies and schools to work together to protect minors online by providing specialized intervention software and better internet literacy education.

- ByteDance decided to implement an automatic “teen mode” on their popular video-sharing app Douyin in 2021 due to growing government scrutiny. This mode places limitations on the amount of time users can spend using the app.

- The regulations, according to the statement, are designed to protect young people’s “physical and mental health” online from various threats, such as invasions of privacy, cyberbullying, and internet addiction.

LINK:https://daoinsights.com/news/internet-addiction-china-rolls-out-most-comprehensive-regulations-yet/