All WeChat content creators and marketing managers will agree that getting organic views under their articles is getting tougher year by year. In the highly-saturated space as WeChat is, ads are of great help but do you want to know how to reach new audiences through organic content? That is possible by collaborating with so-called hot accounts (industry accounts with a big reach and strong reputation) and influencer accounts on WeChat.

We saw a lot of our clients partnering with other accounts to promote their brand but despite sometimes high fees, these sponsored articles didn’t generate any additional traffic or new followers for the client’s account. Did it happen to you too? Learn how to avoid these mishaps in our article and which methods will work towards your particular goals.

What is Whitelisting?

So what is exactly whitelisting and how to share content on Wechat using this method?

Whitelisting is the method of allowing access to resources created and posted by your account to only authorized parties. When it comes to WeChat as a social platform, whitelisting can be very beneficial for users and businesses alike. By leveraging whitelisting your brand can reach new audiences who are already curious about your industry and potential customers.

Shortly, you can allow other accounts to reshare or as WeChat call it, reprint, your articles on their accounts.

Content that can be redistributed in this way must have the ‘original content’ mark meaning that you’re the owner of the content.

Content producers can click the “original content declaration” button in the backend when publishing to claim full ownership of the content. In order to do so the articles must be at least 300 characters long. Note that articles without this designation can be easily copied and redistributed without your knowledge. It’s always good to tick the ‘original content’ box! Find requirements for accounts that post mostly visual-based content and can’t read 300 characters on the official WeChat / Weixin website.

Types of sharing content in WeChat

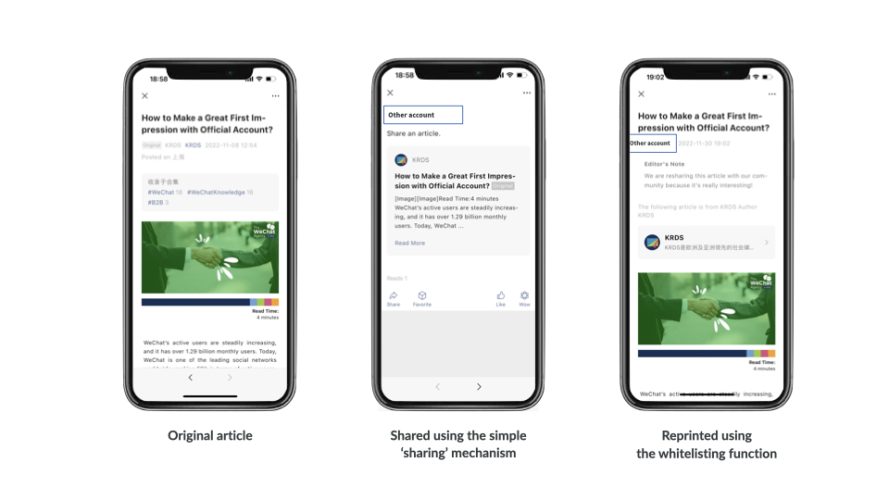

By default, all accounts can reshare articles from other accounts on WeChat. However, this function is not very popular. It doesn’t look aesthetically pleasing or attractive. You can see it below.

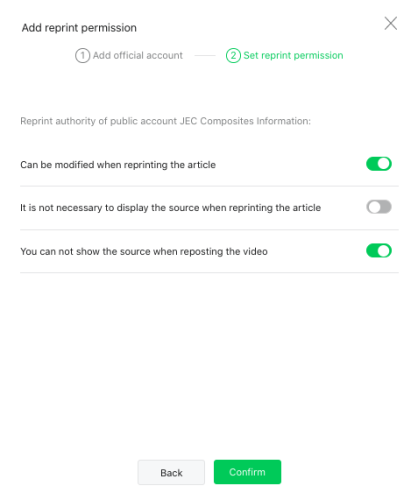

There are two main types of authorization for third-party partners to reprint your content.

First of all, the authorization can be granted for individual articles or for all content posted on your account (global reprint permission 全局可转载帐号). The second option means that the whitelisted partner will be able to share all our articles at any time.

In both cases, you will have additional options to consider when allowing other accounts to reshare your content. You can:

- Require a partner account to display a link to the original official account: You can require always have a link to the original article visible. This will enable the readers to visit the original article and potentially

- Give permission to edit: You can grant the resharing account permission to edit the article; otherwise, the article will be forwarded in its entirety.

As you can see you can choose different options depending if the relationship with the partner is to be a one-off or a long-term one.

Secondly, keep in mind that if you don’t require the partner to show the link to the original article you’re losing the chance to redirect the fans to your account. Having a contact card tile with the link to your account or a QR code is a must if your goal is to drive traffic to your account.

Reprinting – how is it displayed on WeChat?

As you can see in the 3rd option, users will see right away the original source of the article and they can click to follow your account. Your partner on the other hand can add a short note about why they are reposting this article or any other comment or introduction.

New option!

Just recently, we spotted a new feature in the WeChat backend. This new option, ‘quick repost’, means all accounts can repost your new article. This option comes with some limitations but it’s a good way to get your content spread. It gives you less control on who can share the article but on the other hand, accounts won’t be able to remove the source or modify it.

According to WeChat:

- When quick repost is on, the source will always be displayed when this article is reposted, and cannot be modified.

- Quick repost does not affect the repost authorization of whitelisted accounts. The format is as follows.

Interesting thing:

- Reprinted articles cannot contain internal WeChat links.

![]()

Collaboration and mutual distribution

WeChat’s official accounts can work with other accounts in a variety of ways to spread their content among a chosen target audience. This can be done either by providing a ready-to-use article to partners that will be shared via a whitelisting process. You can also opt to create a new, original article.

It is critical that sponsored content maximizes efforts and truly directs readers from the partner account to the original content on your account. For example, a QR code or contact card at the end of the article will help users to reach the original source.

Similarly, if your brand has several official accounts, the most effective way to cross-promote would be to mutually whitelist each other and regularly reshare key content across.

Collaborations with KOLs in WeChat

Collaboration with KOLs (key opinion leaders), your industry experts, or hot accounts from your industry can be very beneficial. After that, publication brands can work with KOLs to direct traffic from these accounts to your account.

Brands that cannot advertise on WeChat

Accounts belonging to restricted industries can also greatly benefit from whitelisting as a key method of promotion on WeChat. Since there are stringent regulations for certain sectors it’s often impossible for these brands to advertise on WeChat.

But brands in these sectors can only grow organically on WeChat and actually thrive. This is where a carefully planned collaboration strategy helps. Because of that collaborations can help reach new audiences, and with whitelisting facilities, organic content from these brands can get better visibility.

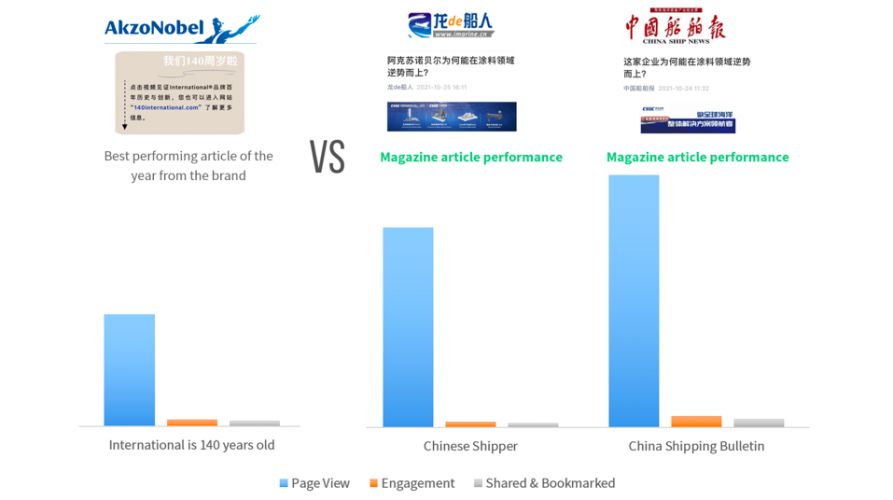

Case study on magazine collaboration

Let’s observe the advantages of collaboration with one of our clients.

Client: AkzoNobel International Marine Coatings

Industry: B2B Marine & Protective Coatings for the shipping industry

Target Audience: Major shipping companies

Objectives: build brand awareness and brand equity

Solution: Collaborate with expert magazines from the industry to publish content from the brand on their WeChat account.

Results: Magazine articles surpassed by 80% and 125% the brand’s best-performing owned article of the whole year among the relevant target audience

These PR-style collaborations also serve as backlinks for WeChat SEO, boosting the brand’s ranking in the WeChat search results. These collaborations produce results both in the short term (by providing brand visibility to magazine followers). In addition, in the long term, it improves the WeChat search index ranking.

🚢You can see the full case study here: Case Study: AkzoNobel (B2B Management)

Conclusion

Collaborations, be they with KOLs or partner brands, are crucial to expanding customer bases by reaching new audiences. In conclusion with whitelisting, you can reach high-quality followers with organic content. This is especially helpful for brands that cannot advertise on WeChat and solely rely on organic content to reach their potential customers.

If you want to know more about collaborations and content sharing on WeChat, please contact our team. We use our knowledge and expertise to help businesses build meaningful partnerships and develop their networks among Chinese customers. For additional information, please contact us at contact@thewechatagency.com.