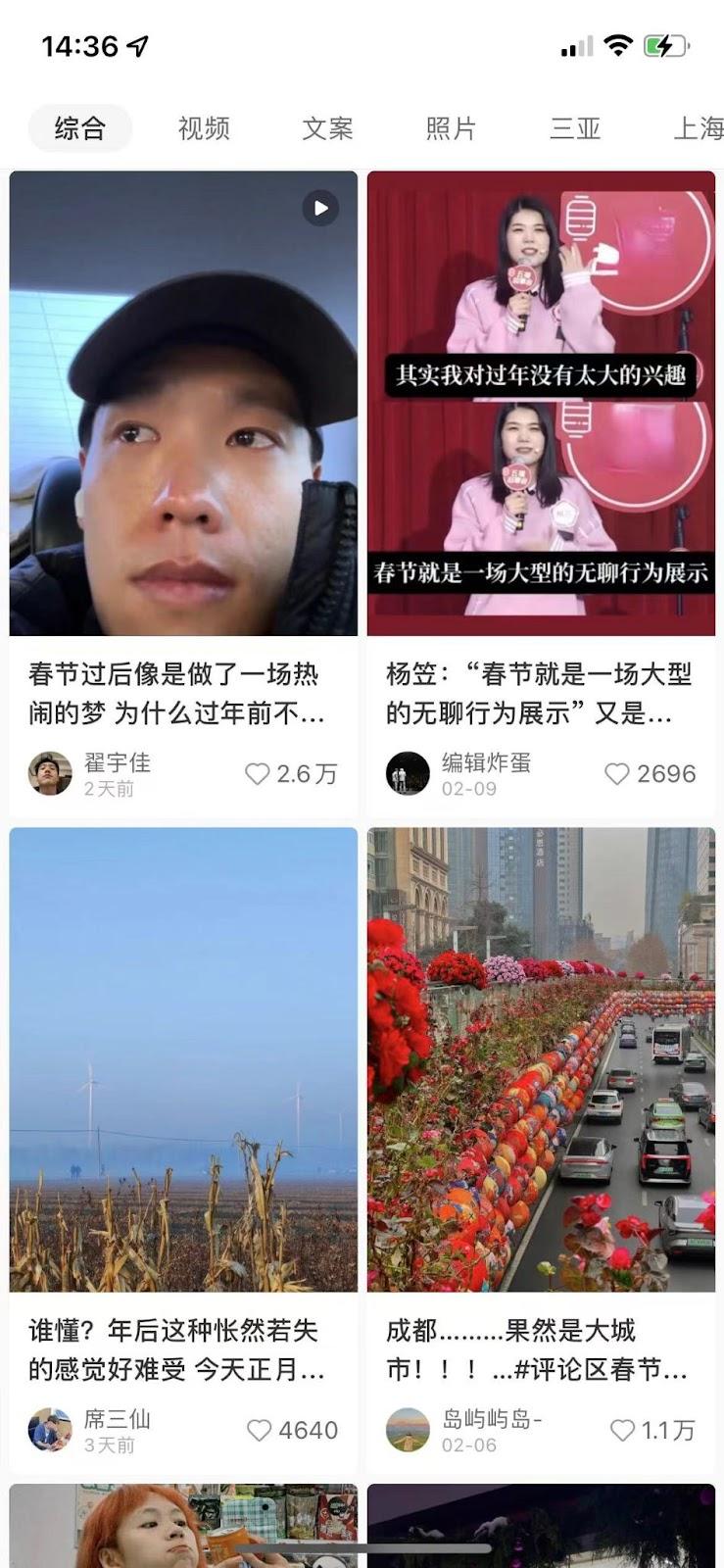

- The unique way that Generation Z in China is celebrating Chinese New Year

- hanfu, prayer bracelets, and a dragon frenzy

Traditional buying habits are changing due to the rise of Generation Z. Traditional gifts are being avoided by younger shoppers. They are choosing, instead, more meaningful and customised things that speak to their unique identities.

- Travelling, but not home

There will be 1.8 million passenger trips per day on average into and out of the Chinese mainland, which is about 3.3 times more than there were the previous year. The majority of these trips were made by people going back to their hometowns. But a growing number of China’s youth is choosing to diverge from this custom, and is instead opting to travel.

- Balancing red packets and financial wellbeing

As members of China’s Gen Z stand at the crossroads of tradition and modernity. They are not abandoning the customs passed down through generations, but are instead redefining them to resonate with contemporary realities and modern demands of financial and emotional well-being.

LINK: https://jingdaily.com/posts/how-china-s-gen-z-is-doing-cny-differently

- Macau welcomes Galeries Lafayette.

The chain’s fourth location in China has opened, Galeries Lafayette, Macau. By 2025, Galeries hopes to have ten locations in China thanks to this new partnership. The pandemic delayed development plans, which had called for the opening of branches in Macau and Chongqing for late 2022.

Galeries Lafayette is refocusing on luxury brands with this new joint venture, with the goal of sharing “a certain vision of the French art of living.”

LINK: https://daoinsights.com/news/galeries-lafayette-lands-in-macau/

- From Hangzhou to Harbin: Alibaba’s Fliggy sets out on winter road trip

- Fliggy, an online travel agency owned by Alibaba, launched a travel campaign by capitalising on the winter travel trend.

- Fliggy Bus made the entire journey to Harbin while offering gifts and coffee along the way. In order to generate interest in snow and ice tourism, Fliggy assumed the role of explorer for this campaign.

- Thanks to deliberate government investments in the industry, ice skating and snowboarding are two of the most popular holiday pastimes for upper-middle class consumers.

- Travelling pop-ups are a great marketing tactic for a spate of brands, not just for travel or outdoor specialists. Non-travel brands can partner up with a travel booking platform or outdoor clothing brand to help provide offline activities to consumers

LINK: https://daoinsights.com/works/from-hangzhou-to-harbin-alibabas-fliggy-set-outs-on-winter-road-trip/

- WeChat E-commerce Amplifies with Video Account Surge

- The 2023 Gross Merchandise Value (GMV) figures are projected to hit between 120 and 150 billion yuan (vs 50 billion yuan in 2022). However, the sector’s scale remains modest compared to giants like Alibaba, JD.com, Pinduoduo, Douyin, Kuaishou, whose GMVs have breached the trillion yuan mark

- A significant development is Tencent’s integration of video account e-commerce with its WeChat advertising system, allowing for video account livestreams to be promoted within Moments. This new feature opens up fresh avenues for traffic acquisition, potentially boosting conversion rates by shortening the consumer journey from ad click to purchase.

- The integration extends beyond advertising, as various e-commerce formats within the WeChat ecosystem, such as social commerce and mini-program commerce, are linked up with video account e-commerce. This strategic move positions video accounts as a foundational infrastructure within WeChat e-commerce, facilitating a seamless flow of both public and private domain traffic within the social network.

LINK: https://www.chinainternetwatch.com/43528/tencent-video-account-ecommerce/