First of all, happy mid-autumn festival from the WeChat Agency team!

China has a very distinct cultural history, traditions, and holidays. Such days continue to be essential marketing touchpoints. In recent times they have evolved into shopping plans for the average consumer.

The second most important festival after Chinese New Year is the Mid-Autumn Festival. This year it falls on September 10.

So for all the businesses out there, this is a fantastic chance for you to draw Chinese customers in with relevant advertising and merchandise!

And without further ado, let’s learn about the Mid-Autumn Festival and how your company can benefit from it.

Mid-Autumn Festival

This holiday which celebrates the end of the harvest season is typically marked by family get-togethers, lantern festivals, and mooncake celebrations, yummy right!

It is celebrated in many other Asian nations as well, such as Singapore, Vietnam, Korea, and Malaysia, and as said earlier, it is the second-most significant festival after Chinese New Year.

When: The Mid-Autumn Festival occurs on the fifteenth day of the Chinese calendar’s eighth month.

Significance: It’s a significant festival in Chinese culture and very comparable to the Western Thanksgiving holiday.

How do people in China celebrate? Friends, family, and delectable food are all that matter, with the mooncake taking center stage.

As the full moon shines brightly in the sky, people also celebrate by lighting decorative lanterns. Mooncakes and other items with festive themes are frequently given as gifts to friends and family.

What ways can brands celebrate?

Moon cakes

Mooncakes are like the life source of this celebration. In fact, the Mid-Autumn Festival is also known as the Mooncake Festival!

Mooncakes can be a fantastic opportunity for brands to use and take full advantage of the festive spirit.

In fact, according to a recent analysis by iiMedia, the size of the Chinese mooncake gift box industry quadrupled between 2016 and 2021, rising from $1.7 billion (11.6 billion RMB) to $2.5 billion (16.9 billion RMB). As a result of this demand, there are now an increasing number of mooncake businesses in China, 40,478 as of July 2022, making it even more important to stand out creatively.

With their purchases, several brands give customers gift boxes of mooncakes to celebrate the Mid-Autumn Festival.

This can be easily accomplished by collaborating with a nearby eatery or food company so that their customers can use a voucher to purchase a gift-boxed mooncake.

Some brands have also put their own spin on the delicacy.

They opt for an experimental mixture rather than the traditional red bean or lotus seed paste. Mooncakes are a significant means by which businesses can show that they are aware of regional customs.

Starbucks, for instance, joined the competition with its own coffee-flavored mooncake! Each was stamped with the Starbucks logo and the promotional Facebook post won over 20,000 engagements.

For the Mid-Autumn Festival, companies can include the moon in their products. In order to maintain the festive atmosphere, Alexander McQueen used traditional ink on a jewel box with festive theme elements that represented the moon and moonlight.

WeChat greetings

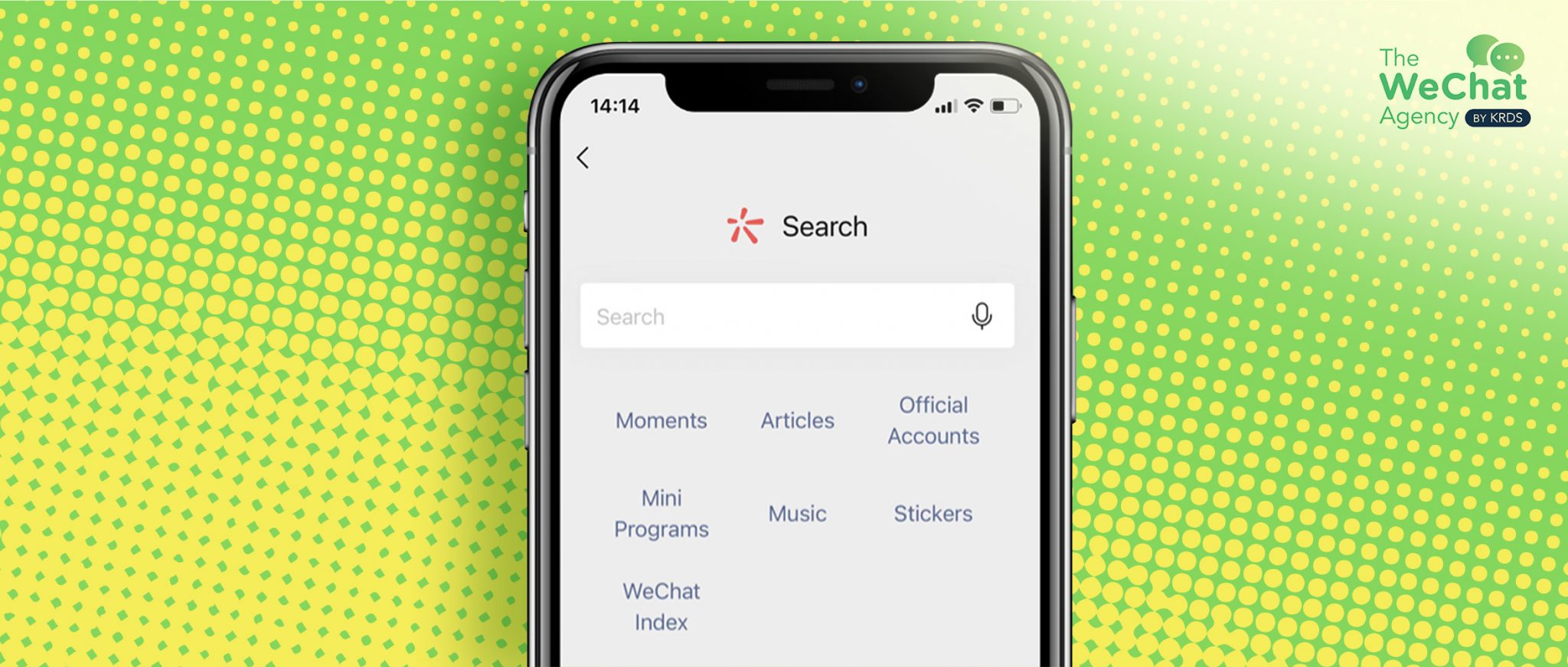

WeChat is a popular platform for friends and family to exchange holiday greetings. The Chinese usually send greetings to one another via WeChat. In WeChat, people also post images of themselves participating in the festival by lighting lanterns and eating mooncakes. Stickers, GIFs are the most popular ways to do that.

Tencent developed “Moonments,” a mixed reality campaign intended to represent the potent force of Chinese culture.

People had to focus on the moon from their current location to create it, and once they did, they were told to choose a location on the Great Wall of China. They will get a view of the moon and the Great Wall of China. They can now choose from a list of traditional Chinese poems about the moon. Finally, you’ll have a poster to share on WeChat Moments with your Moon Festival greeting.

Other brands can also create something special, like Moonments, to engage consumers on special occasions and celebrate Chinese culture.

On September 8th, Ayayi started working for Alibaba as the proprietor of Tmall Super Brand. She had her own ID card and launched the first NFT digital mooncake for the Mid-Autumn Festival.

Gaming

The Mid-Autumn Festival is also a great time to gamify your website or app by providing some sort of competition, gaming experience or scoring, or perks because Chinese people love digital trends, games, and other interactive oddities.

For instance, Kate Spade used WeChat to launch a flight game that spread lovely festival lanterns filled with congratulations across the screen. This made it possible for everyone to spread good vibes and well wishes while sharing the branded lantern with family and friends.

The well-known smartphone app game Angry Birds also celebrated the holiday by switching out its standard golden eggs for lovely golden mooncakes and adding 34 levels with an oriental theme.

Cool campaigns for Mid-Autumn festival

Mooncakes and holiday-related items are the main presents that are given and received. However, young people enjoy shopping particularly, and many companies advertise specialty mooncakes or limited-edition holiday-themed goods.

Let’s take a look at some interesting campaigns that took place in recent years:

Mooncakes from Fendi

Fendi adopted a novel method for designing containers. The brand chose a highly functional cylinder shape that could transform into a lantern because lanterns are a prominent aspect of the Mid-Autumn Festival. A small, vertical set of drawers containing mooncakes is revealed when the cylinder is opened. Each mooncake bears the FF stamp of the company.

The protective film covering a tiny battery on the tube’s side can be removed after the drawers have been taken out and the container has been shut. This activates internal LED lighting that projects light through star-shaped holes onto nearby walls to simulate a starry night. It also rotates.

Their messaging was charming as well. In association with Chinese artist Oscar Wang, they unveiled a 15-second animation featuring Fendidi the Panda. The company’s social media accounts like Weibo, WeChat, and RED, all showed the campaign. Additionally, it was available globally on Facebook, Twitter, and Instagram. It featured adorable depictions of a full moon, an astronaut, and the panda, China’s national animal.

They also ran a mooncake distribution campaign. The company covered a wide range of topics in novel and enjoyable ways.

Perfect Diary: Beauty Products with Mid-Autumn Festival Theme

Some companies choose to use other products that draw inspiration from the holiday rather than traditional offerings like mooncakes. Perfect Diary, a domestic Chinese beauty brand that has been capitalizing on the guochao trend and a strong marketing strategy in the country, released a Mid-Autumn Festival-themed eyeshadow palette.

They collaborated with the Guochao incubator on Tmall and co-branded the palette with China Aerospace Science and Technology Corporation, or NASA in China. Chang’E and Jade Rabbit are two examples of characters from Mid-Autumn Festival fables who reside on the moon that have been given names for China’s lunar probes.

Their Mid-Autumn palette also complimented a line of shadows with an animal theme that the company had started in 2019. The brand ambassador for the “Explorer Eyeshadow Palette 11, Rabbit” was Luo Yunxi, and the campaign included beauty KOLs who posted makeup tutorials using the palette on social media.

The company additionally unveiled a computer-generated campaign video with the moon, other planets, a fictitious model, and an enigmatic rabbit. Over 110 million people have viewed the Weibo hashtag #PerfectDiaryRabbitPalette, and over a million people have watched the video. The young followers of the brand loved it.

HeyTea: Serving young thirsty people

HeyTea took advantage of the opportunity to introduce a special holiday beverage and limited-edition goods. The brand created a special custardy, creamy, yellow bubble tea with a picture of the fabled Jade Rabbit, who resides on the moon, in celebration of the holiday.

In its giveaway promotion, it also provided limited-edition lanterns, stickers, and coupons as prizes. Anyone who interacted with the brand’s accounts on Douyin, Weibo, Xiaohongshu, or Bilibili had a chance to win.

Fans left thousands of comments, reposts, and likes on a Weibo post promoting this unique bubble tea.

Tory Burch: Heartfelt family tales strike the right emotional chord

The American clothing company, Tory Burch, did not introduce any unique mooncakes or packaging. They didn’t try to appeal to Gen Z or create a CGI animation. They chose an approach that was less complicated and got right to the point of the holiday. It all came down to family for them.

The company requested that users share touching family stories on Weibo in exchange for a special gift from the company. They demonstrated their understanding of the holiday and provided a platform for people to express their gratitude by choosing such a meaningful topic with such strong connections to the holiday.

This raised admiration for the brand and raised consumer awareness of it. The brand collaborated with local artisanal businesses to design exquisite packaging for gifts for VIPs and prize winners.

🧧 Check out how other Chinese festivals can be leveraged by brands

Conclusion

Mooncakes, lanterns, friends, and family are the main components of the mid-autumn festival. If you are trying to leverage this festival for sales in the Chinese market, you need to be very creative and innovative in including these in your strategy.

However, Mid-Autumn Festival offerings don’t always have to revolve around mooncakes, lovely jars, or lanterns. Brands can also introduce a limited edition of their usual products and connect it with the holiday through its color, flavor, design, or in other ways.

If you wish to know more about marketing techniques in China, please contact our team. We use our knowledge and expertise to help businesses build meaningful partnerships and develop their networks among Chinese customers. For additional information, please contact us at contact@thewechatagency.com.