1.Alibaba is being urged by Jack Ma to “change and reform”

In an internal memo, Alibaba founder Jack Ma made an infrequent appearance and urged the e-commerce behemoth to “change and reform” following rival PDD’s stronger earnings report, which almost brought Alibaba’s market capitalization within striking distance.

Ma called on Alibaba staff members to return to the company’s mission and vision to reform in order to secure “tomorrow and the day after glory,” while congratulating the eight-year-old PDD for its decision-making, execution, and efforts over the previous few years.

Even though Taobao and Tmall Group are the most profitable divisions of Alibaba, new players in the e-commerce space, such as PDD and ByteDance’s Douyin, are posing a threat.

Ma continued, saying he believed AI e-commerce was only getting started, which offered both an opportunity and a challenge. This statement aligns with Alibaba’s primary strategic focuses, previously disclosed by the new Alibaba CEO Eddie Wu, which prioritise being “user first” and “AI-driven.”

LINK: https://36kr.com/p/2538801460323843

2.Prada showcases beauty and power with women’s national football players

Three players from China’s women’s national football team—Yang Lina, Chen Qiaozhu, and Dou Jiaxing—participated in the launch of Prada’s newest campaign on November 21. This campaign followed the format of their campaign with 4 other Chinese women athletes early last year. Prada and Douyin, the Chinese counterpart of TikTok, collaborated to release a fashion shoot video and two clips featuring football players conducting one another’s interviews.

Prada officially partnered with the women’s national football team in July, just before the FIFA Women’s World Cup.

The players and the Chinese national team received a resounding reception online, garnering over 35,000 likes across the three videos and hundreds of comments, proving that their efforts were worthwhile.

LINK: https://daoinsights.com/news/prada-showcases-beauty-and-power-with-womens-national-football-players/

3.Virtual bling takes over Chinese social media

Young Chinese consumers have discovered a creative way to enjoy a luxurious lifestyle without having to pay the price tag, in an era of digital technology where image frequently takes precedence. With photo editing, users can virtually try on and showcase luxury items like jewellery, handbags, and cosmetics without having to pay for the real thing. This new trend is called dianzi dapai, or “digital high-end brands” in English.

Because it gives young people an alternative to traditional luxury consumption, this newly discovered virtual luxury experience is appealing.

Mixing irony and fun, the trend indicates a shift in how the younger generation perceives and interacts with luxury brands.

Given that numerous luxury brands own patents on their designs, legal experts caution against possible infringement issues.

It sends a strong message to luxury brands hoping to get into or grow in the Chinese market: success in this market will largely depend on how well they can combine the appeal of their goods with the technological sophistication of this market.

LINK: https://daoinsights.com/news/virtual-bling-takes-over-chinese-social-media/

4.What luxury brands can learn from Zara’s new China livestream concept

Zara is setting the bar. At first glance, the brand’s most recent broadcast could be mistaken for a movie or music video backdrop thanks to its 9,000-square-meter set, 12 cameras, and 50 professionals.

Zara’s was much more controlled and orchestrated. The presenter demonstrated the brand’s sophistication and style by taking her time while posing for the products.

With no live broadcasting noise or sales, the anchors were conversing casually about merchandise, coordinated looks, and fashion.

Luxury brands could integrate interactive elements into their broadcasts, like live Q&A sessions with designers or virtual tours of ateliers, for a more holistic brand experience. Making the livestream not just informative but also engaging and memorable.

The goal should be to create a memorable brand experience that resonates with the audience, fostering loyalty and elevating the brand’s status in the consumer’s mind.

LINK: https://jingdaily.com/china-hard-luxury-report-promo/

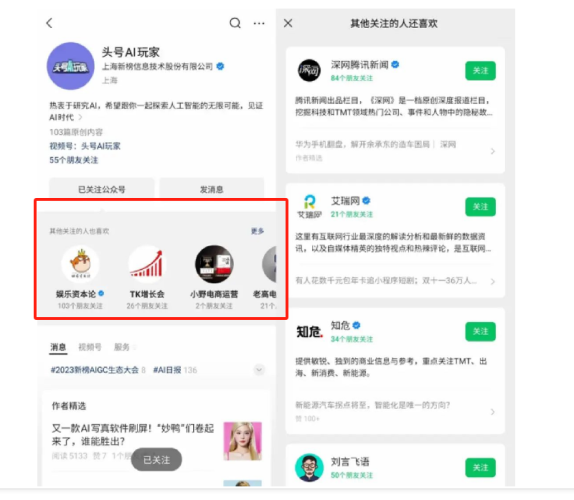

5.WeChat Index Adds Live-streaming as Data Source

WeChat Index added livestreaming as a new source to help users better understand the popularity of keywords within the WeChat ecosystem.

WeChat index live-streaming source data will be factored into the computation starting on October 1, 2023.

The following changes are expected to be observed:

-The index number of keywords will increase.

-Records of changes in keywords may disappear or be added.

-The data source chart adds “live” sources, and the proportion of each source channel will change.

LINK: https://mp.weixin.qq.com/s/lzNt8iVAgwRygrfmclrM5w

6.Luxury Lessons From China’s Singles’ Day 2023

Luxury Brands Adapt to Consumer Behaviour:

Acknowledging the growing trend of “exquisite poverty” (精茴穷) among younger consumers, luxury brands deliberately engaged in Singles’ Day promotions. Companies that understood changing consumer tastes, like Gucci, Balenciaga, and Max Mara, provided exclusive items and interest-free instalment plans.

Trends and AI Integration:

During the event, Gen-Z consumers demonstrated a preference for jewelry, home furnishings, and wedding products. Their skill at taking advantage of platform discounts presented difficulties, though. Additionally, the integration of AI and the promotion of China-focused products emerged as prominent trends, indicating a shift towards technologically-driven shopping experiences.

AI produced virtual try-ons for MCM and Ralph Lauren, using the “Miaoya Camera” to create consumer avatars for clothing try-ons. Tmall (and Taobao) introduced 10 free AI features for merchants and launched a generative AI chatbot named Wenwen to address user queries.

The vulnerabilities of the platform have grown to be a serious problem. By employing reverse bundling strategies to take advantage of sales on high-end merchandise from labels like Dior, Versace, Burberry, and Ralph Lauren, young consumers are gaming the system. These tactics are widely discussed on social media platforms like Xiaohongshu, and their prevalence has disrupted business operations.

It’s a key occasion for consumers in China’s fourth- and fifth-tier cities who lack access to physical luxury brand stores in their areas.

While Tmall and JD.com accounted for the majority of sales during the event, orders across other social commerce platforms were up significantly: 20% on Pinduoduo, 50% on Kuaishou—and Douyin saw a jump of 119%. Xiaohongshu was a big winner too. According to the company, live-streaming sales saw an astounding 420% increase in addition to a 380% year-over-year increase in GMV.

LINK: https://www-forbes-com.cdn.ampproject.org/c/s/www.forbes.com/sites/gemmawilliams/2023/11/15/luxury-lessons-from-chinas-singles-day-2023/amp/

7.Douyin’s e-commerce clampdown: platform cancels controversial sales star Xinba

Popular livestream anchor Douyin banned Xin Youzhi, also known as “sales king” and Xinba, at noon on November 2 for repeatedly posting misleading content, demeaning others, and inciting strife on China’s version of TikTok.

Douyin unveiled new rules earlier this year that prohibit offensive language, unfair competition, and malicious speculating among anchors’ online conduct.

The move against Xinba is an indication that the industry leader in social commerce is taking tough measures against vendors in an effort to raise the caliber of its live streaming offerings.

LINK: https://jingdaily.com/douyins-e-commerce-clampdown-platform-cancels-controversial-sales-star-xinba/