WeChat, widely known as China’s all-in-one super app, has revolutionized the way people communicate, socialize, and conduct financial transactions, but now we’ve got yet another sector coming into the ring.

While it was not initially designed as a travel planning tool, recent developments within the platform indicate a growing appetite to venture into the market share traditionally dominated by Online Travel Agencies (OTAs). This shift is particularly notable, given the whirlwind of changes the travel industry has gone through in recent years. After three long years of restricted international travel due to the global pandemic, the world is witnessing a resurgence in wanderlust. As a result, there has been a noticeable surge in travel-related content on WeChat. Users are sharing their travel experiences, tips, and recommendations, transforming the platform into a hub for travel enthusiasts.

Moreover, recent statistics reveal that a substantial portion of the Chinese population is eager to resume their international travel plans. According to a survey published by Dragon Trail Research, an astounding 60% of Chinese individuals have expressed their intentions to travel abroad this year. This renewed enthusiasm for international tourism presents a unique opportunity for WeChat to leverage its existing user base and expand its influence in the industry.

In this article, we will delve into the emerging travel-related features on WeChat and analyze how they position the platform to potentially challenge the dominance of traditional OTAs. We will also explore the implications of WeChat’s growing travel focus, both for its user base and the wider travel industry, as we navigate the new landscape of post-pandemic tourism.

WeChat as a one-stop platform to organize a trip

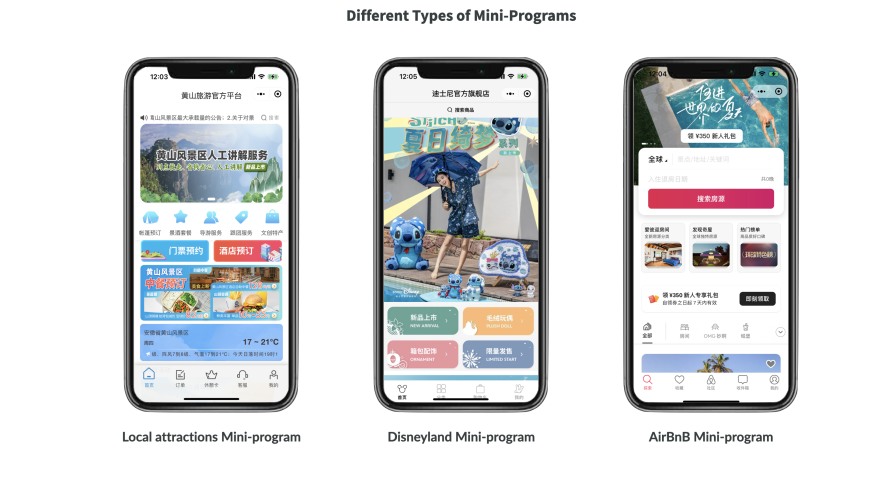

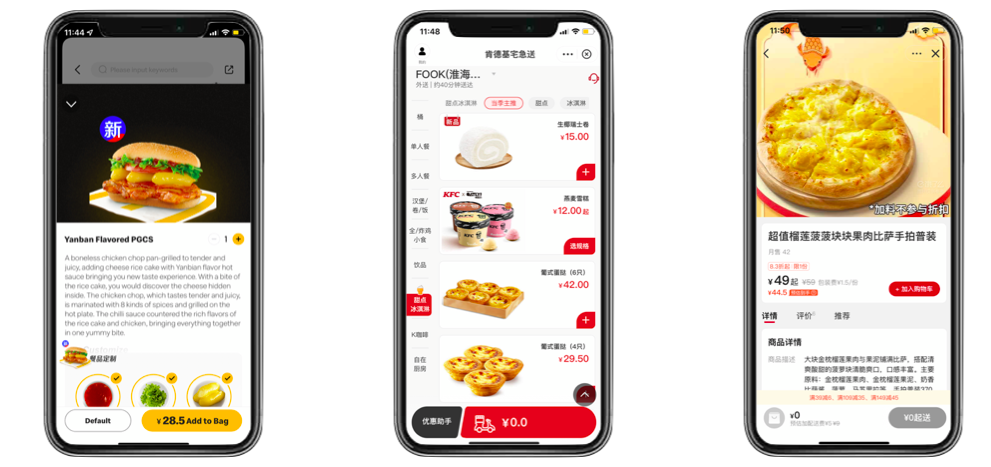

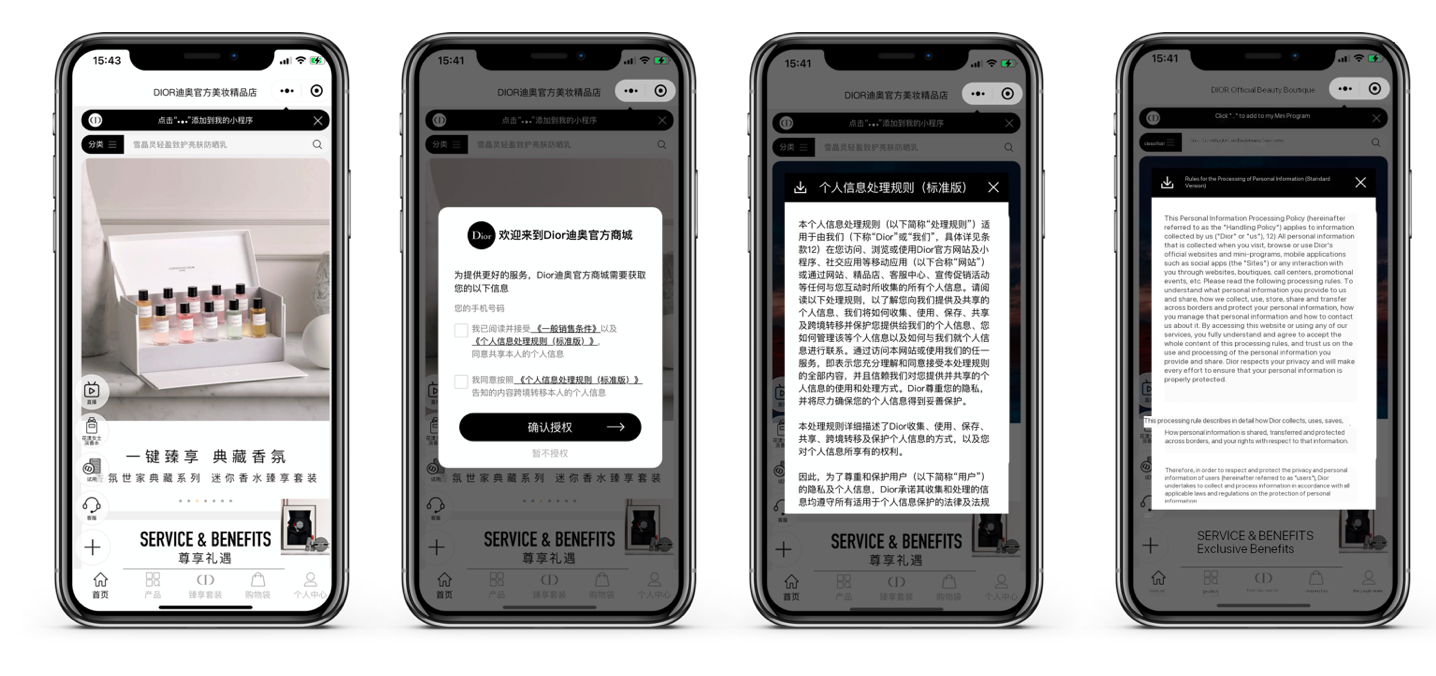

Mini-programs are the core of any planning tools on WeChat. Chinese Travel Consumption Trends White Paper 2023, released by Tencent Marketing Insight and Tongcheng Research Institute highlight the value and popularity of WeChat mini-programs for Chinese travelers. According to the findings, 61% of respondents said they use WeChat mini-programs to purchase travel products and services while on trips. Additionally, 34% stated that they utilize mini-programs for accommodation, transportation, attraction tickets, activities, and/or F&B, while 24% each use the mini-programs of travel platforms and OTAs.

Brands can leverage mini-programs in many ways. For example by embedding a link within the articles, pin to their official account WeChat menus, and much more.

WeChat mini-programs are simply convenient and don’t require downloading additional apps. On top of that, since they are vetted by Tencent they are also perceived as more reliable.

👀 Discover more about WeChat Mini-Programs

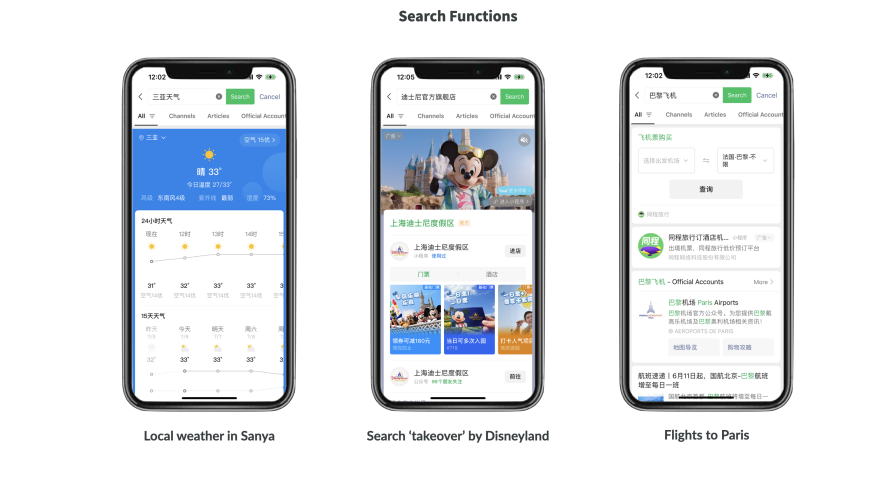

WeChat Search is another amazing tool in the WeChat’s arsenal. Users can search for virtually any kind of information from quick results for the weather forecast at their destination to suggested flight routes or accommodations. In the Search results, users can also browse through official WeChat accounts, video content, mini-programs, and more. Filtering option help them to find relevant information quickly.

One particularly eye-catching feature that can be leveraged by brands is ‘search takeover’ where brands can customize their result card and include buttons driving to different functions like booking.

🔍 A Quick Guide To WeChat Search

Travel Content on Official Accounts

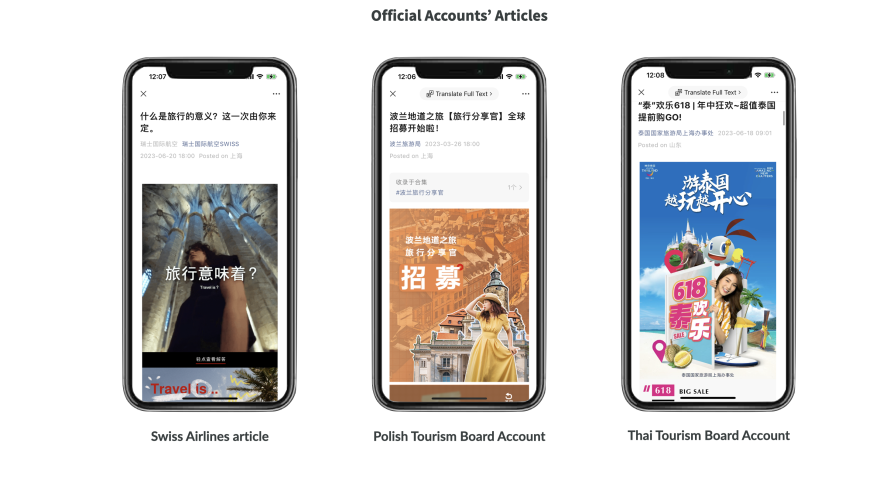

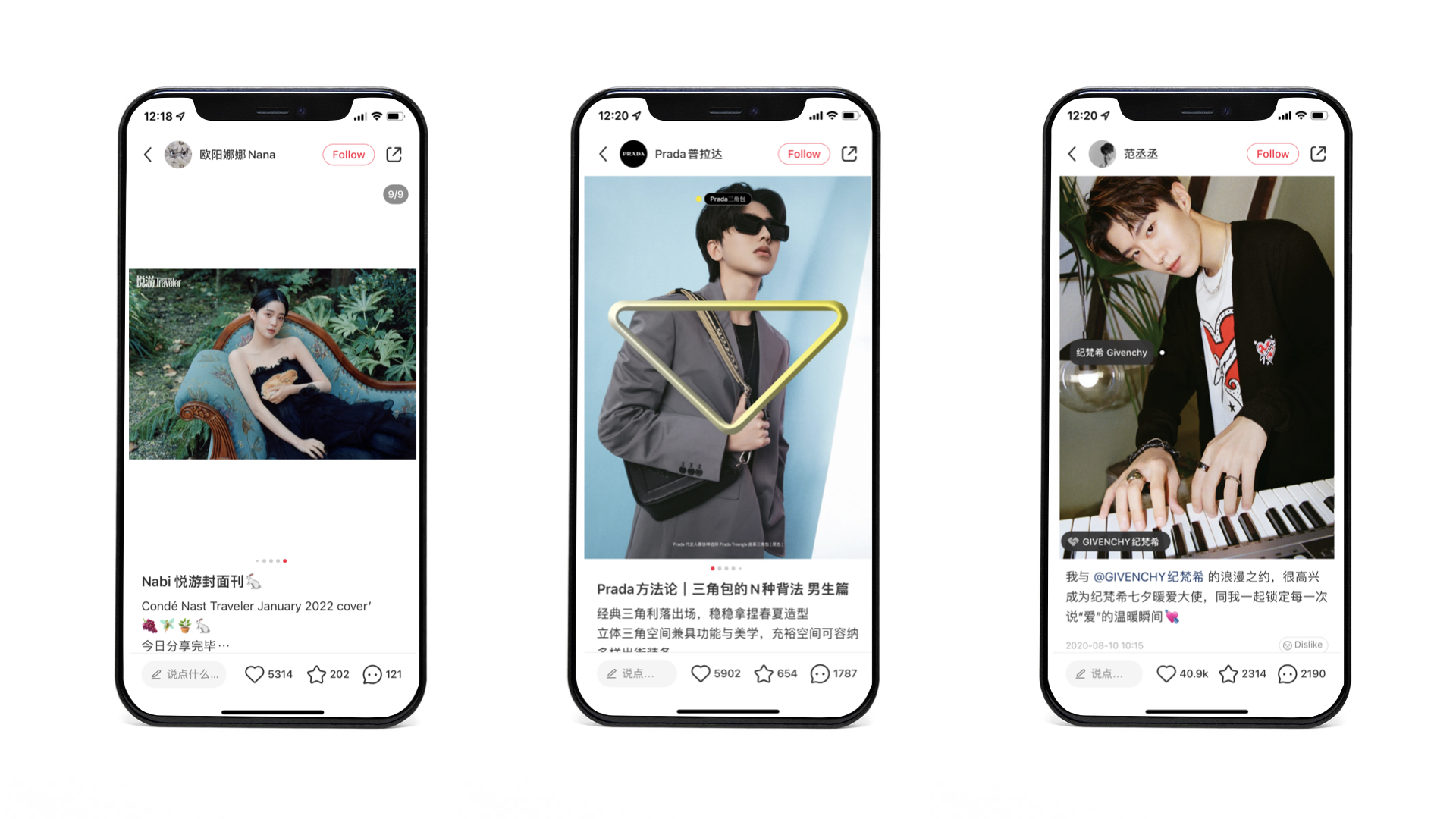

WeChat Official Accounts, let’s not forget content published on official accounts. They remain the most important source of information and updates for Chinese travelers. That’s why it’s so important to keep them up to date. Menu, which is a close equivalent of a website, should be updated and make it easy to navigate for FAQ. Chinese customers will appreciate responsive customer service and auto-replies.

Articles can serve as a great source of inspiration. Taking into account that 17% of Chinese travelers admit that they use WeChat to plan outbound trips, there is a big chance that they might come across the content that spark their wanderlust within the platform. This rising interest in globetrotting content is already visible. According to Q1 2023 WeChat Rankings Report, average views per post on WeChat rose by 41% for airlines. Similarly, 30% for cruise trips, 42% for attractions, and 15% for hotels.

✈️Reaching Chinese Tourists: Online Travel Agencies and Social Media Platforms [2023]

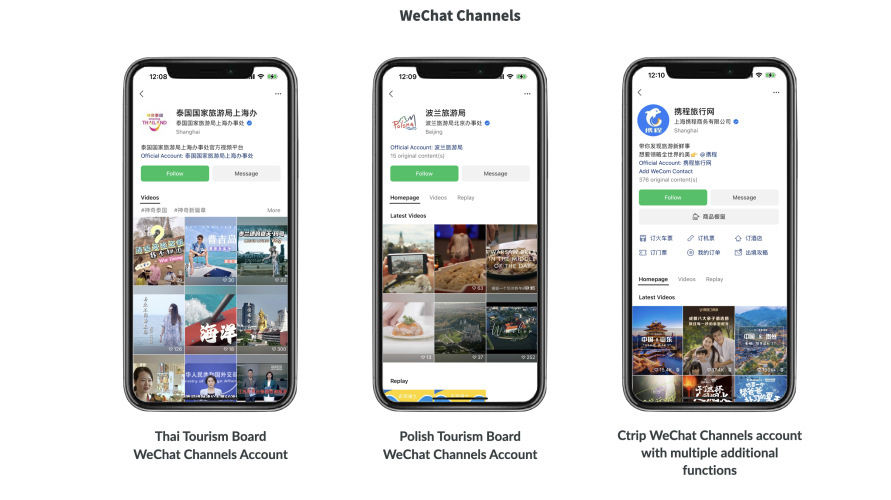

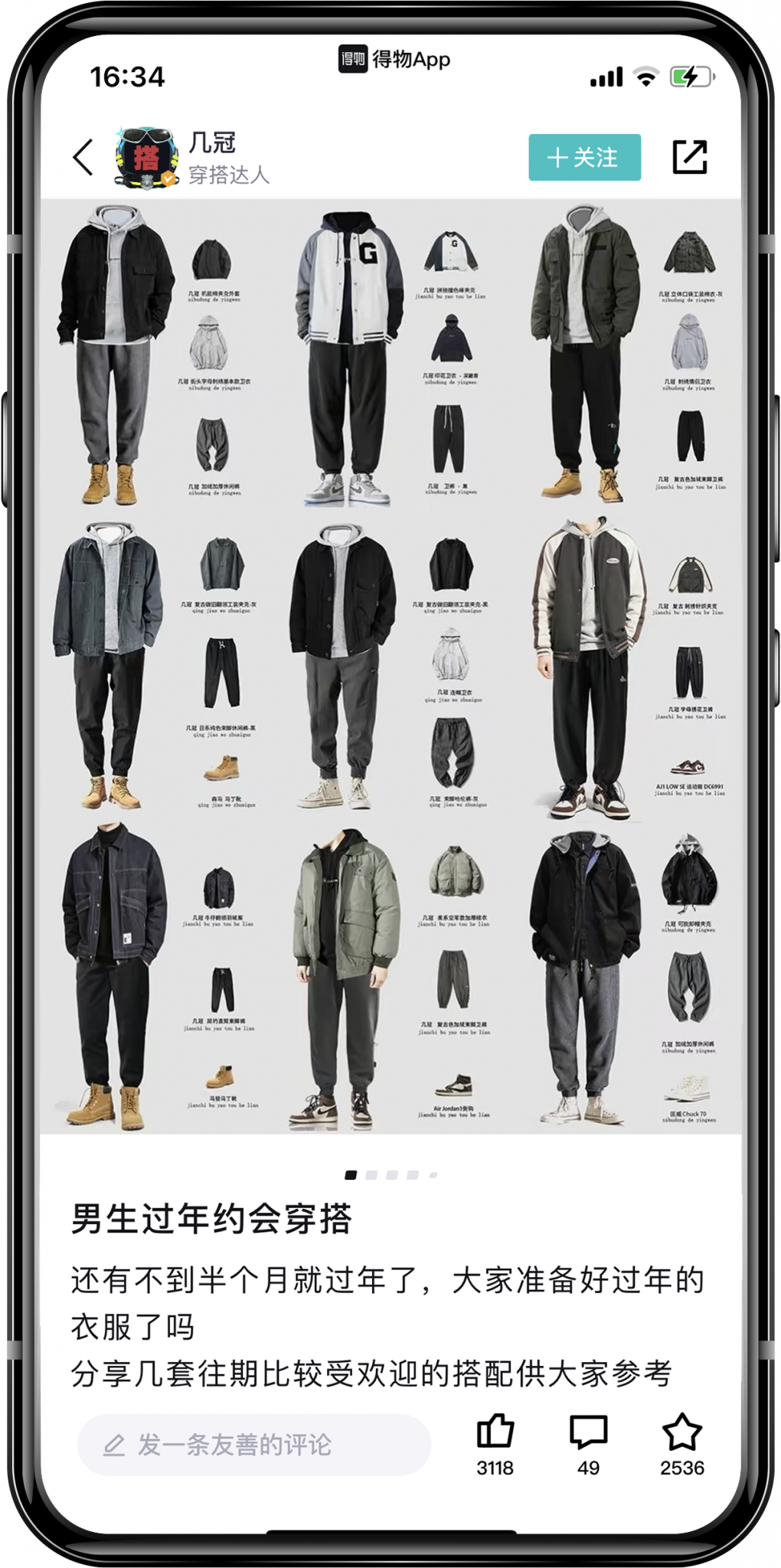

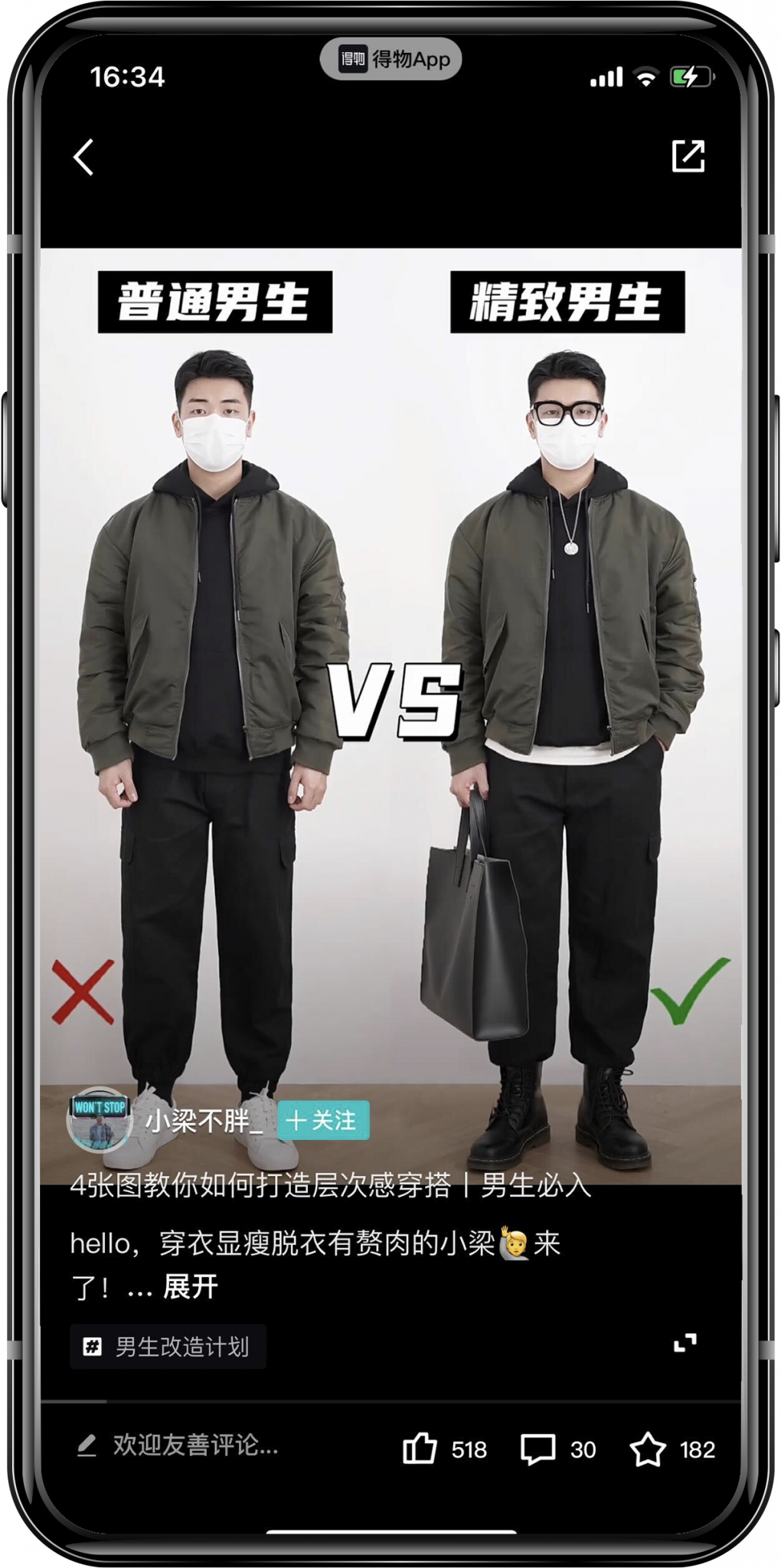

Last but not least, WeChat Channels can be used to find new inspirations. Viewers can discover hot spots in cities and unknown places worth a visit. With similar to Douyin’s algorithm-based feed, Channels are the must-have hub for visual video content on WeChat. Global and local attractions are already using built-in live-steaming features. Users can also browse content based on their location in order to find new hidden gems. They can also create their own content and raise awareness and promote places through UGC (user-generated content).

🎥 WeChat Channels – How to Post for Success?

Conclusions

WeChat recently published a post on how the app can be used for planning a trip from the scratch. All without the need to download any other apps or leaving the platform. Click here to check it: 微信搜一搜是懂五一的. If you have any questions about leveraging WeChat for tourism, please contact our team. We use our knowledge and expertise to help businesses build meaningful partnerships and develop their network among Chinese customers. For additional information, please contact at contact@thewechatagency.com.

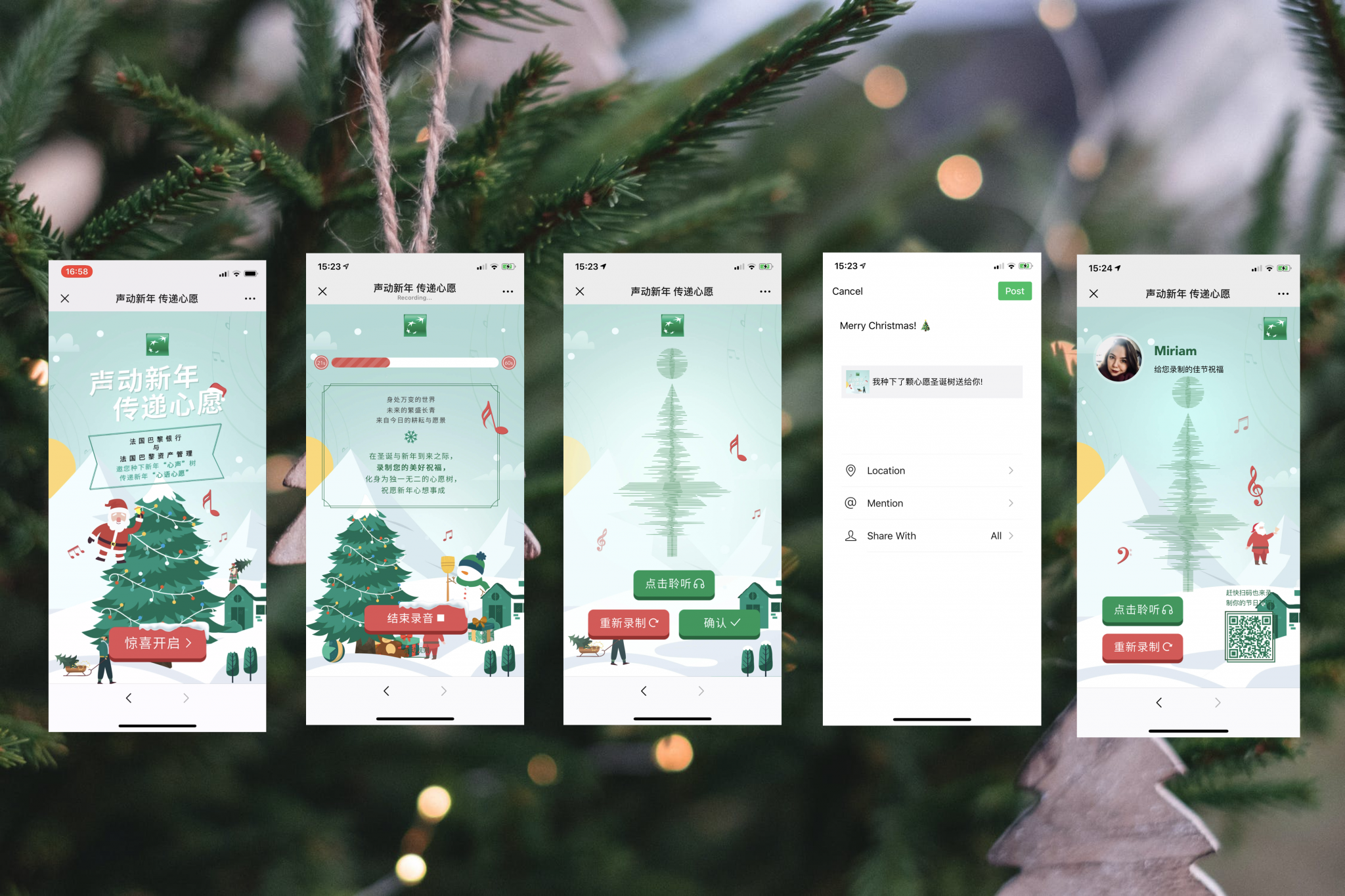

5. KRDS x AkzoNobel – WeChat Article Greeting

5. KRDS x AkzoNobel – WeChat Article Greeting 6. Other Clients

6. Other Clients