WeChat Launches Easy Mode for Elderly

The older generation, even though relatively mobile-savvy, faces a lot of challenges when it comes to mobile services, especially those related to COVID-19. By the end of 2020, more than 123 million Chinese netizens were aged over 60, accounting for 12.3% of the overall internet users. We can expect this trend to grow in the coming years.

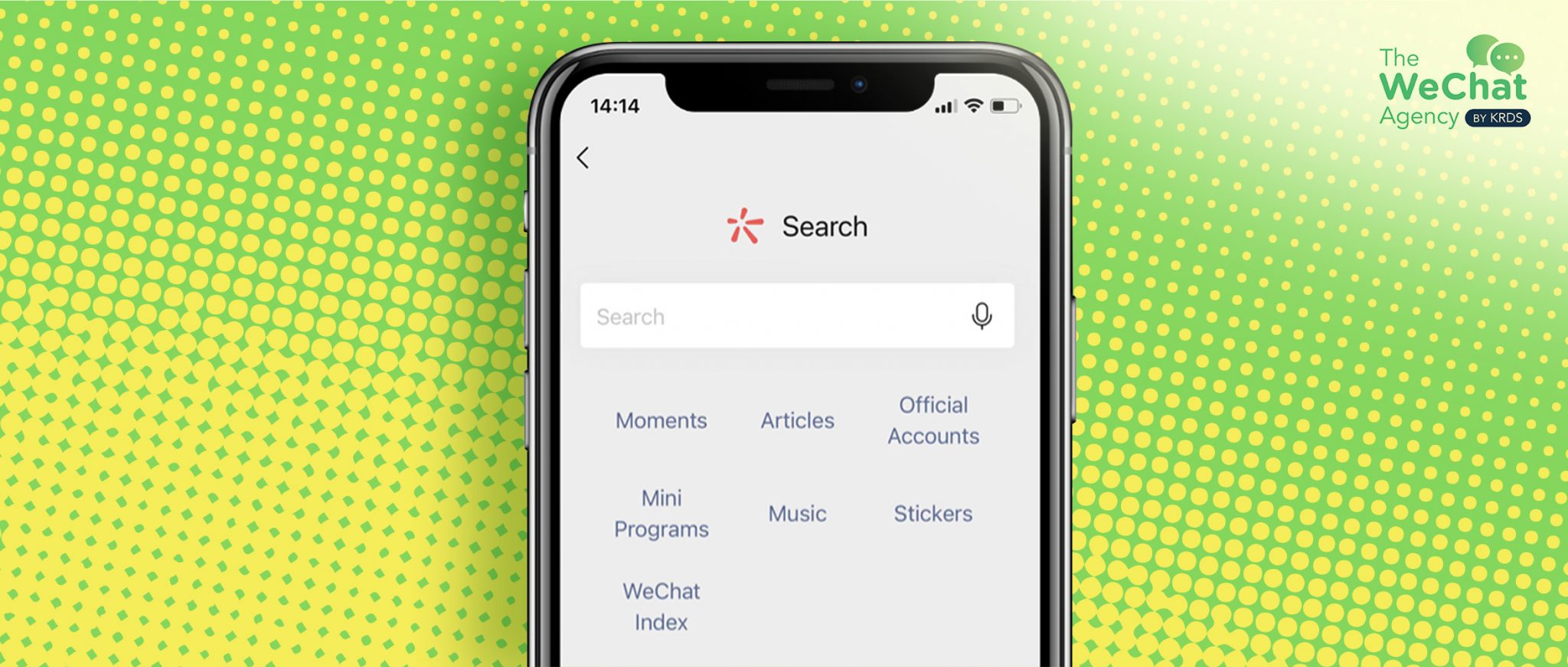

That’s why the Ministry of Industry and Information Technology ordered 43 of the most used applications to take the lead in adapting to the needs of elderly users – Wechat, Taobao and other apps are launching ‘Easy Modes’ to cater to older netizens.

However, these improvements seem to be rather limited with a focus on bigger fonts and brighter colours instead of simplifying the user journey or incorporating voice assistant.

Link: https://daoinsights.com/news/wechat-launched-easy-mode-to-target-chinas-123-million-elderly-users/

Alipay consumption report during National Day holiday

Theme parks are the latest trend: visits soared 936% over the previous month. Fantawild, Disneyland, Universal Beijing Resort, Happy Valley, and Chimelong Resort are the top five parks. Museums, zoos, and resorts were among the top five mini-programs for picturesque areas.

The amount spent in duty-free stores and offline boutiques has surged: in Hainan duty-free stores, the amount spent has climbed by 87%t since 2019. In comparison to last month, the amount spent in boutiques and shopping centres jumped by 40%. Xi’an, Taiyuan, and Zhengzhou, all tier 2 cities, ranked first, second, and third, respectively.

Convenience Store consumption met the peak. Consumption at convenience stores has reached an all-time high. During the holiday, the most popular mini-program was about anti-covid-19, Travel tracking cards; others were about “Order by mobile phone” and Old clothing recycling.

Link: https://mp.weixin.qq.com/s/V_j7k4GjvAUjD-OKmHsj8w

National Day WeChat status

During the National Day holiday, “wishing the motherland” was promoted as the top WeChat status NO.1. The top three are: wishing the motherland, fighting and the unknown.

Wechat status data show that girls love “chilling at home” more and boys “having fun” more. With the decrease of holiday balance, and the set amount of “exhausted” and “worried” is increasing.

More than 3 million WeChat users take more than 30000 steps a day, and more than 4.13 million WeChat users take less than 100 steps a day.