As the Chinese social media landscape continues to evolve, WeChat Channels (视频号) remains a crucial platform for brands looking to connect with Chinese audiences. The key to success on WeChat Channels lies in understanding its recommendation algorithm, which determines which content gets seen and by whom. This blog dives into the core of WeChat Channels’ algorithm, focusing on the different recommendation mechanisms, and provides actionable strategies for optimizing your content to maximize exposure.

Understanding the WeChat Channels Recommendation Algorithm

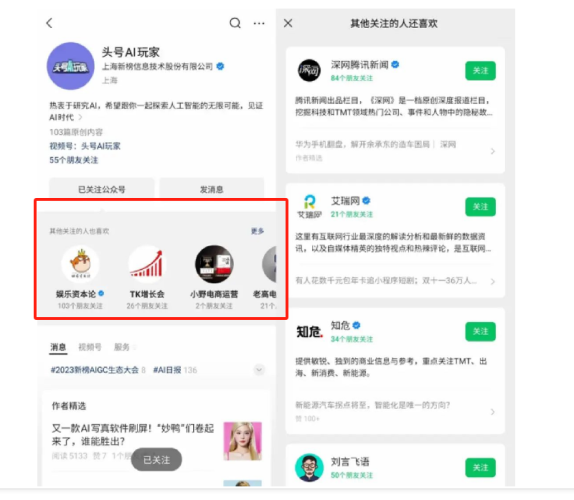

WeChat Channels stands apart from other video platforms, such as Douyin (抖音), by relying heavily on social recommendations rather than interest-based algorithms. According to recent data, 55% of the weight in content recommendations is based on social interactions, highlighting the importance of leveraging existing connections. In comparison, popular content recommendations account for only 15% of the total weight a breakdown of how WeChat Channels determines which content gets promote

-

Social Recommendations (55%)

Engagements from WeChat friends (likes, comments, shares, etc.) play a huge role in determining whether a video gets recommended. If a video receives interaction from users within their social circle, it’s more likely to be recommended to others, creating a snowball effect of increasing exposure.

-

Interest Algorithm Recommendations (20%)

Content is tagged with specific keywords that align with user interests. Based on the user’s interaction history, videos that match their interests are more likely to appear in their feeds. This system uses data such as previous content engagement to make accurate recommendations.

-

Engagement Algorithm Recommendations (15%)

This algorithm looks at engagement metrics such as the number of likes, comments, shares, and completion rates. New content enjoys an initial boost due to its timeliness, meaning fresh videos have a higher chance of being recommended in the early stages.

-

Geolocation Recommendations (5%)

Users are shown content from creators located near them or related to their region, helping them discover videos that are more relevant to their local environment.

-

Hashtag Recommendations (5%)

Hashtags, such as “#topic,” allow content to be aggregated in one clickable hyperlink. Videos tagged with popular or relevant hashtags often get higher visibility, particularly if they are among the top posts related to that topic.

Optimizing Your Content Strategy for WeChat Channels

To ensure that your content reaches a larger audience, it’s important to align your video production with WeChat’s recommendation logic. Here are a few practical tips to help your content perform better:

-

Leverage Social Networks for Social Recommendations

Encourage your followers to engage with your content through likes, comments, and shares. The more interactions your video generates within social circles, the more likely it will be recommended to others.

-

Focus on High-Quality Content

High-definition, clear audio, and unique content stand out on WeChat Channels. Videos that offer original value are more likely to be recommended than reused or low-quality content. Invest in creating videos that offer something new, whether it’s unique insights, educational content, or entertainment.

-

Engage Users Early: The Golden Three Hours

The first three hours after posting a video are critical. During this “Golden Three Hours,” high engagement rates such as completion rates and positive interactions (likes, shares, comments) can trigger further algorithmic promotion. Be sure to promote your videos actively during this window through WeChat Groups, Moments, and other social channels.

-

Publish During Peak User Activity

Timing your posts when your audience is most active can help you gain immediate traction. Posting during high-traffic hours (morning, lunch breaks, evening) maximizes your chances of hitting the right audience at the right time.

Building an Effective Content Strategy: Key Takeaways

-

High Engagement Drives More Exposure

Focus on creating shareable content that encourages users to engage through comments, shares, and likes.

Tag your content with trending or relevant hashtags to increase its discoverability.

-

Create Value-Driven Content

Ensure your content offers something unique that resonates with your audience. Whether it’s education, entertainment, or problem-solving, make sure it’s content with your audience values.

Publish your videos during peak engagement hours and during weekends to capture the maximum number of viewers.

Conclusion

By understanding WeChat Channels’ recommendation algorithm and aligning your content strategy with its logic, you can significantly increase your brand’s exposure on this platform. Remember, social interactions are at the core of WeChat Channels’ algorithm, so creating content that drives engagement is key to boosting your reach.

If you’re looking to optimize your content for WeChat Channels and need help navigating its recommendation algorithm, our team is here to assist you. Get in touch with us today to elevate your digital marketing strategy on WeChat Channels!