In the digital landscape, optimizing search engine results pages (SERPs) is pivotal for foreign brands looking to establish a strong online presence in China. Navigating the intricacies of search engine optimization (SEO) can be a daunting task, especially in a market as distinct as China’s. Let’s dive in to explore fundamental techniques for foreign brands to enhance their SEO strategies for better visibility on search engines like Baidu.

To begin with, it’s crucial to familiarize yourself with the most popular search engines in China, as Google doesn’t operate there. For starters, this understanding lays the groundwork for tailoring your SEO efforts effectively to the Chinese market.

💻 Top Search Engines in China and How They Work

Identifying and Targeting Relevant Keywords

An effective SEO strategy begins with the crucial step of identifying the most relevant keywords for your brand and content. This process involves understanding what terms and phrases your target audience in China is likely to use in their searches. To achieve this, consider the following steps:

Keyword Research: Start with comprehensive keyword research. Tools like Baidu Keyword Planner can provide valuable insights into the popularity and competitiveness of keywords.

Competitor Analysis: Analyse the keywords your competitors are targeting. This can offer a useful reference point and reveal gaps in your own strategy.

Long-Tail Keywords: Consider long-tail keywords, which are more specific and have less competition. They can help you target niche audiences effectively.

Localisation: Localise your keywords to cater to the Chinese audience. Understand that certain keywords may have regional variations in their usage.

Search Engine-Friendly Websites

Ensuring your website is search engine-friendly is the foundation of a strong SEO strategy. Here are key aspects to focus on:

Mobile Optimization: In China, a significant portion of internet users access the web via mobile devices. Ensure your website is responsive and loads efficiently on mobile platforms.

Page Load Speed: Page load speed is a critical ranking factor. Compress images, reduce unnecessary scripts, and enable browser caching to improve load times.

Chinese Hosting: Hosting your website in China can significantly improve loading speeds. Local hosting minimises latency and enhances the user experience.

Chinese Domain: Consider registering a Chinese domain (ending with .cn) to signal to Baidu and users that your content is relevant to China. Baidu prioritizes indexing websites that have ICP. Those who don’t would find it very hard or even impossible for Baidu to index its contents. You can check what exactly ICP is in our previous post.

Tracking SEO Performance and Making Adjustments

SEO is not a static process; it requires continuous monitoring and adaptation. Regularly track your SEO performance to identify areas for improvement. Here’s how to do it effectively:

Analytics Tools: Implement analytics tools like Baidu Analytics or Google Analytics to monitor website traffic, user behaviour, and conversion rates.

Keyword Ranking: Keep a close eye on your keyword rankings. Identify keywords that are performing well and those that may need adjustment.

Content Audit: Regularly audit your content to ensure it remains relevant and valuable. Remove outdated content and update existing pages to align with current trends and user intent.

Backlink Analysis: Monitor your backlink profile and disavow low-quality or spammy backlinks that can negatively impact your SEO.

Additional Resources and Expertise

To delve deeper into the world of Baidu SEO, consider leveraging resources from reputable sources and collaborating with experts in the field. Here are some additional tips:

Educational Material: Explore educational material on Baidu SEO, such as blogs, articles, and guides.

Online Courses: There are online courses and certifications available that can enhance your understanding of SEO practices in China.

SEO Agencies: Collaborating with local SEO agencies in China can provide you with the expertise required to navigate the intricacies of Baidu and its algorithms.

Stay Updated: SEO is an ever-evolving field. Stay updated with the latest trends, algorithm changes, and best practices to maintain a competitive edge.

Less obvious facts that SEO optimisation is easily overlooked

Geographic positioning: Firstly, determine the user’s geographical location based on their IP address and return search results that are more suitable for the user’s geographical location.

Above The Fold: Secondly, place the most important information on the first screen and capture the user’s attention within a few seconds.

Social media optimisation: Lastly, publish high-quality content on mainstream media platforms, encouraging users to actively engage with the contents

Main Differences between Baidu and Google

While Baidu places greater emphasis on the quantity and quality of links, Google, on the other hand, focuses more on the content relevance and website quality of external links. Baidu places a higher emphasis on the quantity and quality of external links because it believes that these factors are crucial indicators of a website’s authority and credibility.

In contrast, Google prioritizes the content relevance of external links and the overall quality of link sources. This distinction arises from Google’s algorithms, which can adeptly identify content relevance and link quality.

Google’s attention is directed towards factors such as the content’s relevance to the linked page and the overall quality of the source website, including considerations such as website credibility, page quality, and traffic. As a result, Google assigns higher weight to the external links originating from high-quality websites.

🔍 Check out our introduction to Baidu SEO for Beginners

Baidu Index

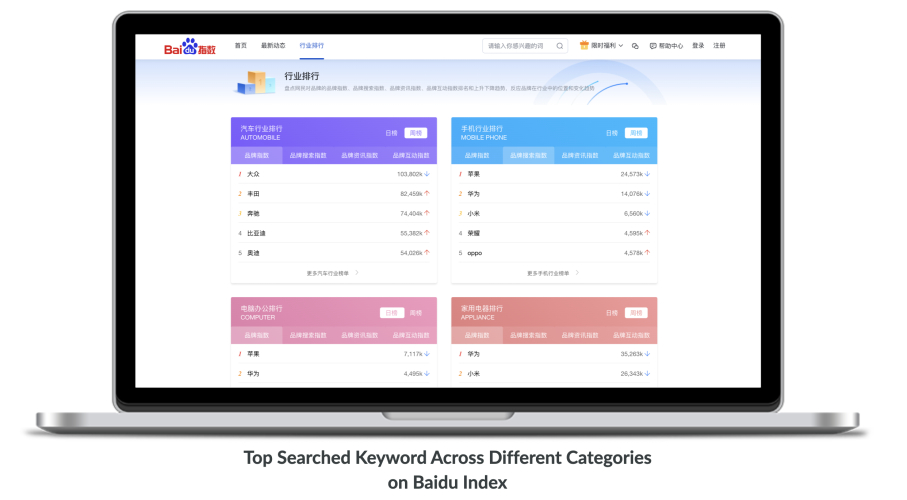

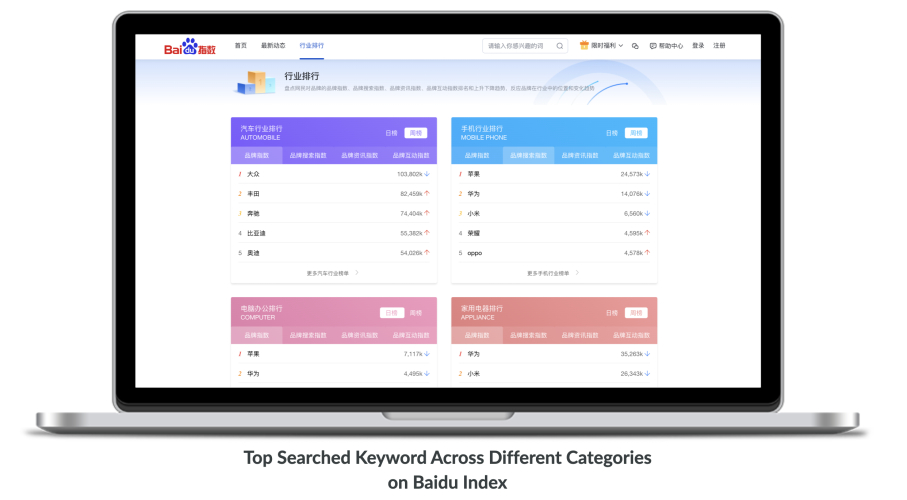

Then, there is also the Baidu Index. Baidu Index is a tool provided by Baidu, the leading Chinese search engine. It allows users to track and analyze the popularity and trends of search queries on the Baidu platform. It is similar to Google Trends but specific to Baidu’s search data.

Furthermore, Baidu Index provides a platform for users to input keywords or phrases, allowing them to observe how the search volume for those terms has changed over time. This information is not only valuable but essential for businesses, marketers, and researchers. Additionally, it aids in understanding the interest and popularity of certain topics in the Chinese market, offering insights that can shape strategic decisions.

The tool provides a wealth of data, encompassing the number of searches, regional interest, related queries, and other relevant information. This multifaceted information proves instrumental for various purposes, ranging from market research and content planning to gauging the effectiveness of online campaigns within the dynamic landscape of the Chinese internet.

Moreover, it’s essential to note that access to Baidu Index is contingent upon having a Baidu account. Additionally, the tool not only facilitates a holistic understanding of user behavior but also uniquely tailors its features to primarily focus on Chinese language search queries. This linguistic emphasis underscores the significance of cultural and linguistic nuances when delving into the intricacies of the Chinese online ecosystem.

Conclusions

In conclusion, optimizing SERPs for foreign brands in China emerges as an essential aspect of digital marketing. It is imperative to identify and target relevant keywords to ensure your website is search engine-friendly.

Moreover, continuously tracking SEO performance becomes a crucial practice. This approach enables you to significantly enhance your online visibility and effectively connect with the Chinese audience.

It’s crucial to remember that SEO is a long-term investment. Patience and persistence are key to achieving lasting results. As you embark on your SEO journey in China, consider it an ongoing process of improvement and adaptation. The digital landscape evolves, and so should your SEO strategy. Stay proactive in adjusting your approach to align with the dynamic nature of online trends and search engine algorithms.

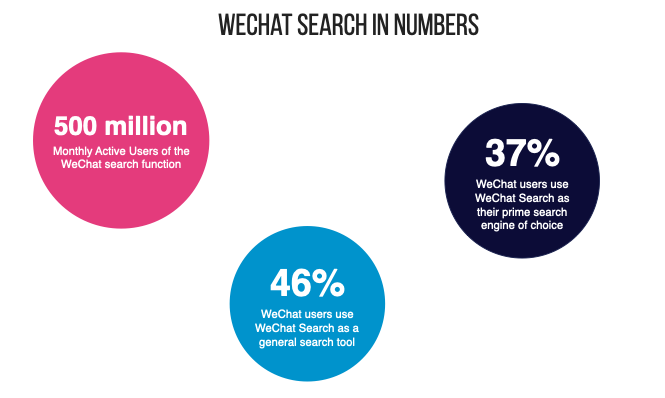

You might want to explore our article on WeChat Search for further reading.

For further information, please feel free to contact us at contact@thewechatagency.com to learn more.