Douyin is China’s leading short-video and social-commerce platform, developed by ByteDance. Known internationally as TikTok’s Chinese counterpart, Douyin combines entertainment, e-commerce, and community engagement within one ecosystem. This article explores what Douyin is, how it works, its business opportunities, and its growing influence across culture, fashion, and digital trends. It’s designed for professionals seeking a deep understanding of China’s short-video economy.

What Is Douyin? Definition, Origin, and Global Context

Douyin is a Chinese short-video app launched by ByteDance in 2016. Initially named A.me, it was rebranded as Douyin within months to appeal to the domestic audience. Its growth was exponential, reaching 100 million users in its first year and surpassing 750 million monthly active users and 400 million daily users by 2025.

Douyin is available only in mainland China and runs on a separate infrastructure from TikTok. TikTok serves global markets, while Douyin operates under Chinese data-protection and content-regulation frameworks. The platform’s ecosystem goes beyond entertainment: it’s a core driver of digital marketing, live commerce, and lifestyle culture in China.

Douyin vs. TikTok: Key Differences and Similarities

Although Douyin and TikTok share ByteDance’s parent company and a similar interface, they function as distinct platforms. Douyin complies with Chinese cybersecurity and censorship laws, storing data domestically and featuring additional functions not present in TikTok, such as in-video search, location-based recommendations, and integrated e-commerce tools.

TikTok, meanwhile, follows international privacy standards and features independent content algorithms. Accounts, likes, and posts cannot be transferred between the two apps. The split ensures localized user experiences and legal compliance in each market.

How Does Douyin Work? Core Features and User Experience

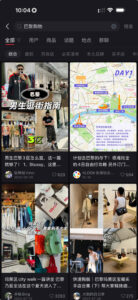

Douyin centers on short-form video creation and discovery. Users can film, edit, and publish directly within the app using an extensive toolkit — AR filters, background music, sound effects, and transitions. Its AI-driven recommendation feed analyzes user behavior to curate a highly personalized “For You” experience.

Community interaction happens through comments, duets, and hashtags, which amplify viral challenges and cultural memes. The platform also integrates live streaming and shopping functions that turn engagement into transactions.

Unique Features of Douyin in the Chinese Market

Douyin includes advanced features built for China’s digital ecosystem:

- AI face search and visual recognition allow users to locate products seen in videos.

- Booking services for hotels, restaurants, and travel are available directly inside the app.

- Payment integration with Alipay and WeChat Pay enables seamless purchases.

- Teenage mode introduces time limits and content filters to comply with youth-protection laws.

Together, these features make Douyin not just a content platform but a complete digital-lifestyle hub.

Business, Monetization, and Influencer Ecosystem on Douyin

Business Accounts

Brands operating in China can register verified business accounts using a Chinese business license. Verification unlocks analytics dashboards, ad-management tools, and the ability to launch official e-commerce stores.

Advertising Formats

Douyin offers multiple ad solutions, from native feed ads and hashtag challenges to brand takeovers and livestream promotions. Its performance-based metrics help marketers track impressions, engagement, and conversions directly within the app.

Influencer Marketing

KOLs (Key Opinion Leaders) and micro-influencers dominate Douyin’s ecosystem. Their authentic reviews, tutorials, and livestreams directly shape consumer decisions, especially in fashion, beauty, and food.

E-Commerce Integration

Users can buy products without leaving Douyin. Shopping carts, product pages, and affiliate links are embedded inside videos or livestreams. The platform supports one-click checkout and verified merchant stores.

Revenue Models for Influencers

Creators earn income through virtual gifts, brand partnerships, affiliate commissions, and live-shopping sales. High-performing KOLs can turn content engagement into measurable revenue streams, reinforcing Douyin’s role in China’s creator economy.

Cultural and Social Impact of Douyin in China

Douyin has reshaped how China’s youth communicate, consume, and define trends. It drives viral challenges, music hits, and internet slang, often influencing traditional media. The platform also empowers subcultures — from guofeng (国风) traditional aesthetics to cosplay and dialect humor — giving local communities visibility on a national scale.

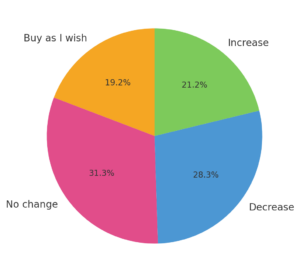

Its influence extends to purchasing habits: viral products, travel destinations, and restaurant trends often originate on Douyin. By merging storytelling with commerce, it has become a blueprint for China’s digital-first consumer culture.

What Does Douyin Mean in Fashion and Digital Aesthetics?

Live Commerce and Real-Time Fashion Hauls

Douyin’s live-streaming ecosystem is transforming fashion retail. Influencers host real-time try-ons and styling sessions, with products purchasable during broadcasts. Data-driven insights and algorithmic recommendations push trending items to relevant audiences, turning spontaneous engagement into instant sales.

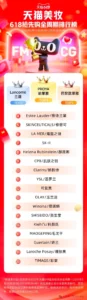

Douyin Makeup and Beauty Trends

“Douyin makeup” has become a defining aesthetic across Chinese social media — characterized by smooth skin, gradient lips, and expressive eyes. Tutorials and reviews from creators have propelled Chinese beauty brands to prominence, influencing makeup trends from Shanghai to Seoul and even Western platforms like TikTok and Instagram.

Privacy, Regulations, and Controversies Around Douyin

Douyin operates within China’s strict content and cybersecurity laws. The platform enforces real-name registration, content moderation, and data localization, ensuring compliance with national standards.

Teenage-protection measures limit daily screen time and restrict access to sensitive topics. However, these controls have also attracted criticism regarding censorship and limited creative expression. For international observers, Douyin represents the balance between innovation and regulation in China’s internet governance.

Frequently Asked Questions About Douyin

What does “Douyin” mean?

In Chinese, 抖音 (Dǒu yīn) translates to “shaking sound,” referring to rhythm and movement in short videos.

Is TikTok available in China?

No. TikTok is the international version of Douyin, operating outside mainland China.

Can you access Douyin outside China?

Yes, but the app’s features — especially e-commerce — are optimized for users in mainland China.

How does Douyin impact global fashion trends?

Its beauty and style aesthetics inspire viral trends worldwide and influence TikTok creators.

What are the main business opportunities on Douyin?

Brand storytelling, live commerce, influencer marketing, and in-app advertising.

What are the regulatory differences between Douyin and TikTok?

Douyin abides by China’s cybersecurity laws, while TikTok follows international compliance frameworks.