In the world of social media, one question consistently confuses users, marketers, and tech policy experts alike: Does China have TikTok?

It is a reasonable assumption. After all, TikTok is owned by ByteDance, a Chinese tech giant. However, if you open the App Store in Beijing or Shanghai, you won’t find the TikTok logo on anyone’s screen. Instead, you will see a different, albeit familiar, app called Douyin.

Understanding the distinction between these two platforms is crucial for anyone navigating the digital landscape. This article unpacks the complex relationship between TikTok and Douyin, explaining why they are separate, how they differ technically, and what this means for global tech policy.

Does China Have TikTok? Understanding the Difference Between TikTok and Douyin

To answer the main question simply: No, the global version of TikTok does not exist in China.

While both apps are developed by the same parent company, ByteDance, they operate as entirely separate entities. TikTok is available in over 150 markets worldwide—except for mainland China. For the domestic Chinese market, ByteDance operates Douyin.

The decision to create two distinct platforms was driven by the need for strict regulatory compliance and content control within China. By separating them, ByteDance allows Douyin to thrive under local laws while TikTok expands globally.

- Douyin: Serves over 700 million daily active users in China.

- TikTok: Boasts over 1 billion users globally.

Corporate Structure and Regulatory Context

The separation is not just cosmetic; it is structural.

- ByteDance is a Chinese tech company with subsidiaries around the world.

- TikTok Ltd is headquartered outside of China (with bases in Singapore and Los Angeles), whereas Douyin is run entirely from within mainland China.

- Regulatory Pressure: Chinese data and content regulations require local platforms to enforce strict censorship and real-name registration. To navigate this, ByteDance chose to “silo” its international product (TikTok) from its domestic product (Douyin) to prevent cross-border regulatory conflicts.

Technical and Content Differences Between TikTok and Douyin

While they share a similar “scroll-to-watch” interface, the engines running them are different.

- Infrastructure: The apps use separate databases, servers, and have their own algorithmic tuning.

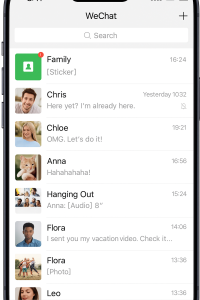

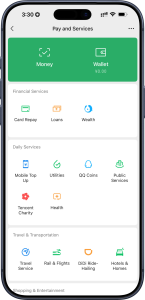

- Features: Douyin is far more advanced in terms of monetization. It integrates direct e-commerce, hotel bookings, and even advanced search-by-face features that are not present in TikTok.

- Compliance: Douyin complies with Chinese censorship laws, restricting politically sensitive topics and enforcing a mandatory “teen mode”. TikTok, conversely, operates under international community guidelines.

Is TikTok Available in China?

If you travel to China, you will quickly find that TikTok is not available.

- Access Blocked: TikTok cannot be downloaded from official Chinese app stores, and the app itself blocks access if it detects a mainland Chinese SIM card or IP address.

- The Great Firewall: Like Facebook or Google, TikTok’s servers are blocked by China’s Great Firewall.

- Douyin Only: The only ByteDance short-video app promoted and accessible in the country is Douyin.

While some users attempt to access TikTok using VPNs, it is technically difficult and comes with risks, as the app is aggressively geofenced.

Why Is TikTok Blocked in China?

It seems ironic that a Chinese-owned app is blocked in China, but the reasons are political.

- Information Sovereignty: Chinese authorities seek to maintain strict control over the information flow within their borders.

- Uncontrollable Content: Because TikTok is designed for global users, its content cannot be centrally censored by Chinese regulators in real-time.

- Prevention of Cross-Border Talk: Separating the apps prevents Chinese citizens from communicating directly with the global internet on a platform not subject to local oversight.

What is Douyin and How Does It Differ From TikTok?

Douyin (抖音) is ByteDance’s original short-video success story, launched in 2016. While it looks like TikTok, it feels very different to use.

- Super-App Features: Douyin is deeply integrated into the Chinese digital ecosystem. Users can buy products, book restaurants, and access services without ever leaving the app.

- Content Differences: You will find more local news, educational content, and “patriotic themes” on Douyin compared to the entertainment-focused content on TikTok.

- Algorithms: The recommendation algorithms are tuned differently to account for local cultural factors and regulatory requirements.

Content Controls and ‘Teen Mode’ on Douyin

One of the starkest differences is how Douyin manages younger users.

- Real-Name Registration: It is mandatory for all users to register with their real identity.

- Strict Teen Mode: For users under 14, access is heavily restricted. There are daily time limits, and content is “whitelisted” to show only educational inputs like science, history, and patriotism.

- Government Pressure: These features are a direct result of government pressure to curb internet addiction and block “undesirable” material. This contrasts sharply with TikTok’s approach, which relies more on parental controls and optional settings.

Why Does ByteDance Maintain Two Separate Apps?

The dual-app strategy is a calculated survival tactic.

- Legal Compliance: Chinese law strictly prohibits the free flow of unmonitored information across its borders. Local apps must comply with data and content laws that would be unacceptable in Western markets.

- Global Scaling: Operating two apps allows ByteDance to scale TikTok globally without being weighed down by Chinese censorship rules, while simultaneously dominating the domestic market with Douyin.

- Data Silos: By keeping user data and algorithms separate, ByteDance attempts to protect itself from regulatory risk—preventing the US from claiming American data is in China, and preventing China from worrying about foreign influence.

Implications for Global Tech Policy and Data Privacy

This split has become a focal point for international debate.

- Global Scrutiny: Governments in the US and EU continue to scrutinize TikTok’s data practices, questioning if the separation from its Chinese parent is truly watertight.

- National Security: The core concern is whether the Chinese government could force ByteDance to leverage its ownership to access cross-border data, despite the operational separation. This debate highlights the growing tension around digital sovereignty in a fragmented internet.

Frequently Asked Questions: TikTok, Douyin, and China

Is there TikTok in China?

No, TikTok is not available in mainland China. The version of the app used in China is called Douyin. It is a separate app with its own servers and content ecosystem.

Can Chinese users access international TikTok content?

Generally, no. Chinese users cannot access or post on TikTok due to the Great Firewall and app restrictions. Furthermore, content posted on TikTok is not visible on Douyin, and vice versa—the two digital worlds do not connect.

Is Douyin safer or more censored than TikTok?

Douyin is subject to much stricter censorship and government oversight than TikTok. It employs mandatory real-name verification and filters politically sensitive content to align with Chinese regulations. TikTok operates under international standards but faces its own scrutiny regarding data privacy and user safety.

Why is TikTok’s global presence controversial?

The controversy stems from ByteDance’s Chinese ownership. Governments, particularly in the US, worry about potential national security risks, such as the Chinese government theoretically accessing foreign user data, leading to ongoing debates about bans and divestiture.